Using the account setup seen previously, let’s go through an example. Assume that there are 2 employees (E1 and E2) which each earn $1000 per month gross salary. The employee contribution to Tax1 and Tax2 are 10% and 5% respectively. The company contribution to Tax1 and Tax2 are 15% and 10% each on top of the employees gross salary.

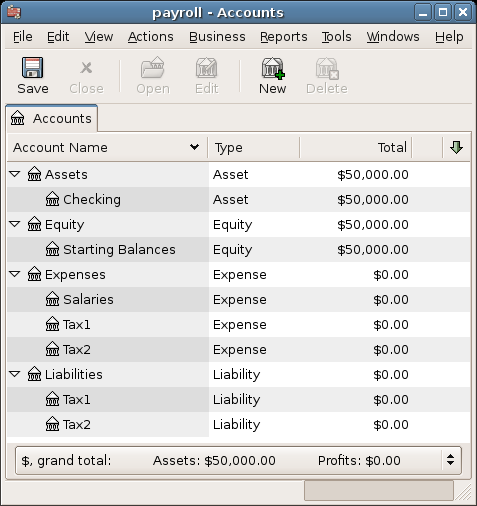

Staring with $50k in the bank, and before doing any payroll, the account hierarchy looks like this:

Payroll Initial Setup

The deductions list for employee 1:

E_GROSS_SALARY - Employee gross salary - $1000

E_TAX1 - Employee contribution to tax1 - $100 (10% of E_GROSS_SALARY)

E_TAX2 - Employee contribution to tax2 - $50 (5% of E_GROSS_SALARY)

C_TAX1 - Company contribution to tax1 - $150 (15% of E_GROSS_SALARY)

C_TAX2 - Company contribution to tax2 - $100 (10% of E_GROSS_SALARY)

Table 14.2. Transaction Map for Employee 1

| Account | Increase | Decrease |

|---|---|---|

| Assets:Checking | $850 (E_NET_SALARY) | |

| Expenses:Salaries | $1000 (E_GROSS_SALARY) | |

| Liabilities:Tax1 | $100 (E_TAX1) | |

| Liabilities:Tax2 | $50 (E_TAX2) | |

| Expenses:Tax1 | $150 (C_TAX1) | |

| Liabilities:Tax1 | $150 (C_TAX1) | |

| Expenses:Tax2 | $100 (C_TAX2) | |

| Liabilities:Tax2 | $100 (C_TAX2) |

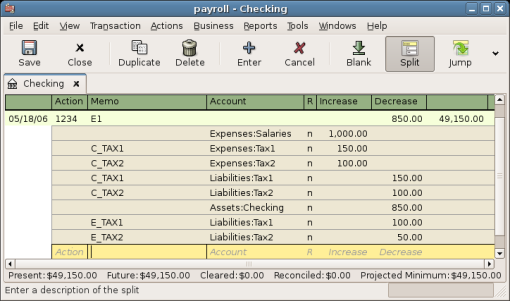

Now, enter the first split transaction for employee 1 in the checking account. The split transaction looks like this:

Employee 1 Split Transaction

| Tip |

|---|---|

When paying employees, enter only the employee name in the Description area. If you decide to use | |

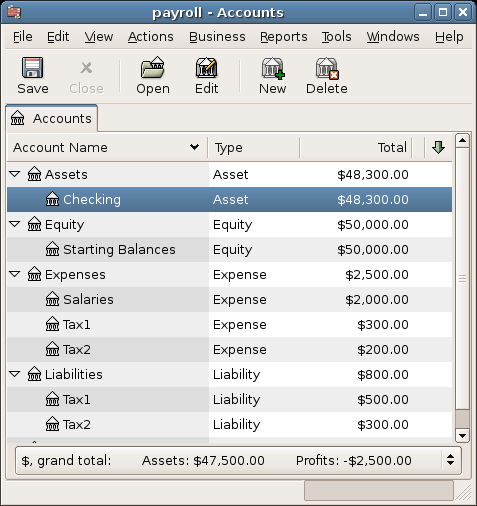

Repeat this for the second employee, which leaves the account hierarchy looking like this:

Account Tree After Salaries Paid

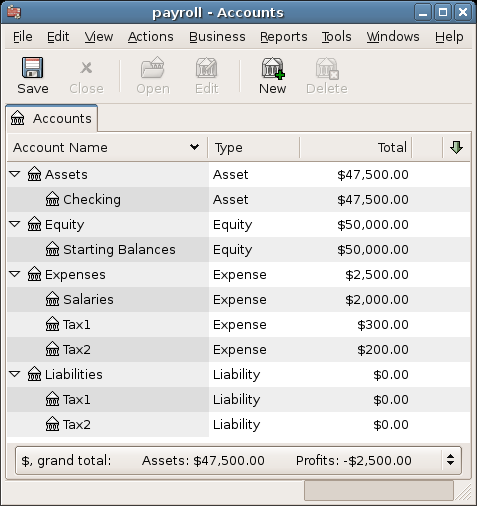

The Liabilities:Tax1 and Liabilities:Tax2 accounts continue to track how much you must pay to the government agencies responsible for each. When it is time to pay these agencies, make a transaction from the checking account to the liability accounts. No expense accounts are involved. The main account will then appear like this for this example:

Accounts After Paying Government