In this Putting It All Together you will use quite a bit of what you have learned so far in this guide with a bit of a twist. The twist being a lot of different currencies.

The following are the basic scenarios.

You live in Australia and use AUD as our default currency

You win the lottery as well as inherit some money

You pay of your existing house loan

You purchase some stocks in Sweden using SEK (Ericsson B-Fria)

You purchase some stocks in HK using HKD (Beijing Airport)

You purchase some stocks in US using USD (Amazon)

You lend some EURO to a friend (Peter)

You borrow some money from a Japanese bank

You buy a house in New Zealand

You use a credit card in Australia

You would like to have maximum control of your expenses

| Note |

|---|---|

Again these samples are not intended as a valid and

accurate advice. They are only to be considered as a sample for

the techniques used in | |

This time let’s start with a fresh and new GnuCash data file, so

→ , and edit

preferences ( → ,

→ on Mac OS X)

to set Default Currency as AUD. Since you have

decided to be able to track as much of your various expenses and incomes

as possible, the following account hierarchy could be used;

Assets:Current Assets:Savings Account (AUD)

You open the mail one morning, and to your enormous surprise find that you are the last living relative of a very distant relative who happened to be very rich. And also $500,000 AUD richer. That was not the last though, another mail states you won the lottery, and got $250,000 AUD for that.

To record these transaction we need the following accounts

Equity:Lottery (AUD)

Equity:Inheritance (AUD)

The transactions you enter into your Assets:Current Assets:Savings Account should look like this.

Table 10.3. You come into some extra money

| Account | Increase | Decrease |

| Income:Lottery | $250,000 | |

| Income:Inheritance | $500,000 |

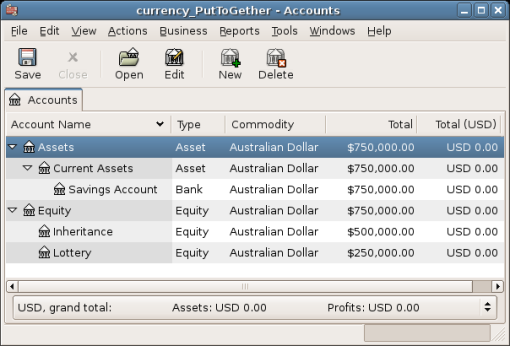

And the Chart of Accounts looks like this after above transactions have been entered.

Chart Of Accounts after receiving some money

At last you can afford to pay of that house loan you had to take some years ago (with a $50,000 deposit).

Assets:Fixed Assets:House (AUD) $300,000

Liabilities:Loans:Mortgage (AUD) $250,000

Expenses:Interest:Mortgage Interest (AUD)

Equity:Opening Balance (AUD) $50,000

After you have had a small chat with your Mortgage bank, they agree to let you pay it all of in one go, plus some interest (AUD 30,000). You should enter the following split transaction into Assets:Fixed Assets:House account.

Table 10.4. Paying of the house mortgage

| Account | Increase | Decrease |

| Assets:Current Assets:Savings Account | 280000 | |

| Expenses:Interest:Mortgage Interest | 30000 | |

| Liabilities:Loans:Mortgage | 250000 |

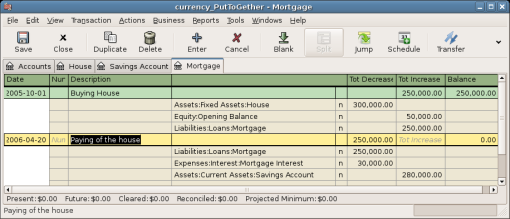

The Liabilities:Loans:Mortgage account Transaction Ledger looks like this after the transactions have been entered

Transaction Ledger of the House Loan

Since you quite suddenly have a lot of money in your bank account, you decide to visit a Financial Advisor, and after his recommendation (remember, this is fictional - Not a genuine stock purchase advice) you decide to purchase Telecommunication (Ericsson in Sweden), Beijing Airport (Hong Kong), and Amazon (USA).

The needed accounts to track these investments looks like this.

Assets:Investments:Swedish Broker:ERIC.ST (STOCK ERIC.ST Yahoo)

Assets:Investments:Swedish Broker:Bank (SEK)

Assets:Investments:HK Broker:0694.HK (STOCK 0694.HK Yahoo)

Assets:Investments:HK Broker:Bank (HKD)

Assets:Investments:US Broker:AMZN (STOCK AMZN Nasdaq)

Assets:Investments:US Broker:Bank (USD)

Expenses:Investments:Commissions:Swedish Broker:ERIC.ST (SEK)

Expenses:Investments:Commissions:HK Broker:0694.HK (HKD)

Expenses:Investments:Commissions:US Broker:AMZN (USD)

Expenses:Investments:Currency Transfer (AUD)

You decide to invest $100,000 into each stock, and to do this we first do a currency transaction to the various bank accounts associated with the stock.

The transaction you enter into your Assets:Current Assets:Savings Account should look like this.

Table 10.5. Transfer money to overseas with a multiple currency transaction split.

| Account | Deposit | Withdrawal | Exchange Rate | Transaction Fee |

| Assets:Investments:Swedish Broker:Bank | 100000 | 5.5869 | 35 | |

| Assets:Investments:HK Broker:Bank | 100000 | 5.8869 | 30 | |

| Assets:Investments:USD Broker:Bank | 100000 | 0.7593 | 25 |

Now when there is some money in the various stock brokerage accounts, you ask each broker to buy stocks for the certain amount. Remember to execute the transaction from the stocks associated bank account, and if the Exchange Rate window do not pop up, right click the row and manually start it. Enter the number of stocks you purchase in the last entry (To Amount:).

Table 10.6. Purchasing oversea stocks

| Stock Symbol | Number of shares | Amount | Commission |

| ERIC.ST | 15000 | 270000 | 400 |

| 0694.HK | 70000 | 280000 | 300 |

| AMZN | 1000 | 32000 | 25 |

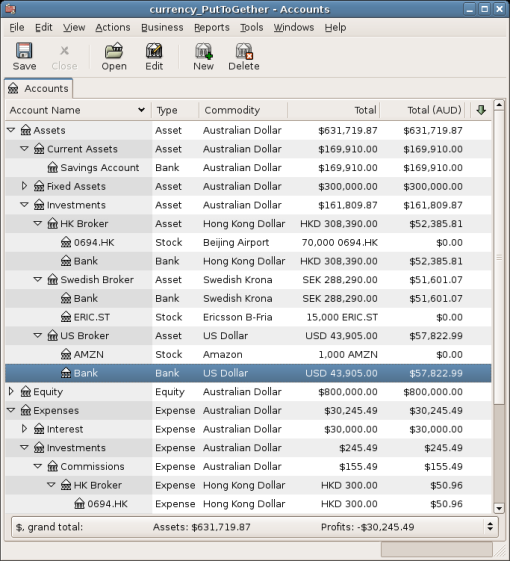

As you can see in the Chart of Accounts, you have now purchased stocks in three different currencies (HK, USD, as well as in SEK), but the Chart of Account (as seen below) do not indicate how much it is valued in your home currency, AUD.

Some of the accounts in Chart of Accounts after the stock purchase

Next section will ensure you get the various exchange rates so GnuCash can show your

total worth in the local currency (AUD in this case)

To get the current exchange rates and stock quotes, go to → and then click on .

Peter has run into some difficulties all the way over in Europe Land. Since he is a very dear pal of yours, you decide to help him out with a personal loan of 40,000 Euro.

Assets:Money owed to me:Euro:Peter (Euro)

Income:Interest Income:Peter (Euro)

Expenses:Bank Charge (AUD)

This is a simple currency transaction from your Savings Account (AUD), to your Assets:Money owed to me:Peter (EURO) account. You got the exchange rate of 0.606161, which means you need to withdraw AUD 65,989.10, as well as pay the service fee of 35 AUD.

Your long time Japanese friend offers you a Japanese house loan if you purchase a property overseas, with only AUD 50,000 as deposit. After having discussed this with your Financial Advisor in Australia and gone through the various risks and benefits related to your situation, you decide to accept his offer.

| Note |

|---|---|

Again, this should not be taken as a financial advice. Please consult with a registered financial advisor before undertaking investing (or speculating) in overseas markets, or local markets for that matter. A word of warning might be of interest here, taking a loan overseas for a very low interest rate might seem like a very good deal. Do keep in mind though that the exchange rate might change and can change drastically. If you take a loan in your local currency, you only have to worry about the interest rate. Taking a loan overseas, then you have to worry about the interest rate and the exchange rate. | |

You found a nice small cottage in a small coastal town near Auckland which would be a perfect summer house, and you decide to use the money from Japan for this purpose.

We need the following accounts for this example;

Liabilities:Loans:Japan Loan (JPY)

Expenses:Interest:Japan Loan (JPY)

Expenses:Mortgage Adm Fees:Japan Loan (JPY)

Assets:Current Assets:Japan Bank (JPY)

Assets:Fixed Assets:NZ House (NZ)

Table 10.7. Buying a NZ House Split Transaction

| Account | Increase | Decrease |

| Assets:Fixed Assets:NZ House | 300000 (NZD) | |

| Assets:Current Assets:Savings Account | 50000 (AUD) (1.18926) | |

| Liabilities:Loans:Japan Loan | 28000000 (JPY) (0.0137609) | |

| Expenses:Mortgage Adm Fees:Japan Loan | 300000 (JPY) (0.0137609) |