To setup investment accounts in GnuCash you can either use the

predefined investment account hierarchy or create your own. The minimum

you need to do to track investments is to setup an asset account for each

type of investment you own. However, as we have seen in previous chapters,

it is usually more logical to create a structured account hierarchy,

grouping related investments together. For example, you may want to group

all your publicly traded stocks under a parent account named after the

brokerage firm you used to buy the stocks.

| Note |

|---|---|

Regardless of how you setup your account hierarchy, remember that you can always move accounts around later (without losing the work you’ve put into them), so your initial account hierarchy does not have to be perfect. | |

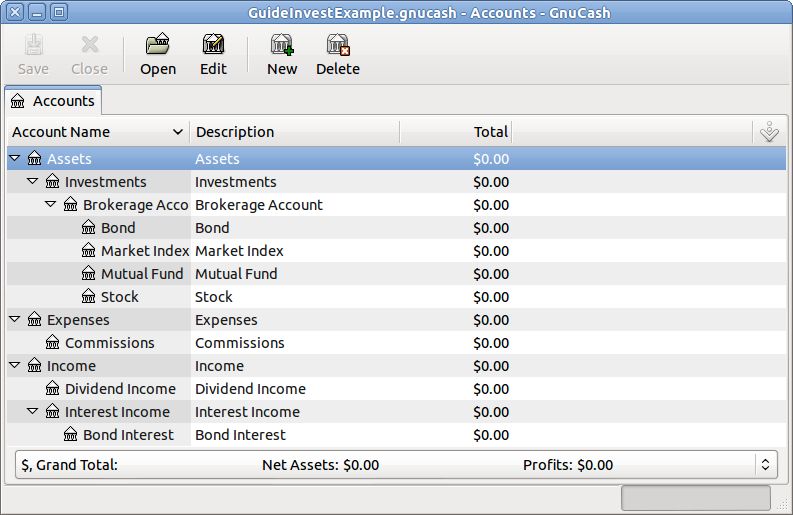

The Investment Accounts option of the

New Account Hierarchy Setup assistant will

automatically create a basic investment account hierarchy for you. To

access the predefined investment accounts hierarchy, you must make

sure your GnuCash file is open, switch to the

Accounts tab, and choose

→ . This will run the New

Account Hierarchy Setup assistant and allow you to select

additional accounts to add to your account hierarchy. Choose the

Investment Accounts option (along with any

others you are interested in). Assuming only investment accounts were

selected, this will create an account hierarchy as shown

below.

| Tip |

|---|---|

You can also run the New Account Hierarchy

Setup assistant by creating a new | |

|

This is an screen image of the Accounts tab after creating a new file and selecting only the default investment accounts.

You will probably at least want to add a Bank account to the Assets and probably an Equity:Opening Balances account, as we have done in previous chapters. Don’t forget to save your new account file with a relevant name!

If you want to set up your own investment accounts hierarchy, you may of course do so. Investments usually have a number of associated accounts that need to be created: an asset account to track the investment itself; an income account to track dividend transactions; and expense accounts to track investment fees and commissions.

The following is a somewhat more complicated example of setting up

GnuCash to track your investments, which has the advantage that it

groups each different investment under the brokerage that deals with the

investments. This way it is easier to compare the statements you get

from your brokerage with the accounts you have in GnuCash and spot where

GnuCash differs from the statement.

Assets

Investments

Brokerage Accounts

I*Trade

Stocks

ACME Corp

Money Market Funds

I*Trade Municipal Fund

Cash

My Stockbroker

Money Market Funds

Active Assets Fund

Government Securities

Treas Bond xxx

Treas Note yyy

Mutual Funds

Fund A

Fund B

Cash

Income

Investments

Brokerage Accounts

Capital Gains

I*Trade

My Stockbroker

Dividends

I*Trade

Taxable

Non-taxable

My Stockbroker

Taxable

Non-taxable

Interest Income

I*Trade

Taxable

Non-taxable

My Stockbroker

Taxable

Non-taxable

Expenses

Investment Expenses

Commissions

I*Trade

My Stockbroker

Management Fees

I*Trade

My Stockbroker

| Tip |

|---|---|

There really is no standard way to set up your investment account hierarchy. Play around, try different layouts until you find something which divides your investment accounts into logical groups which make sense to you. | |