State Sales Taxes

In United States and some other countries, there are several federal taxes including the state sales tax. A state government may have a totally different sales tax rate(s) than the other. Interestingly, the state government may require you to apply different sales tax for the same item, depending on :

Type of Customer

- Type of Establishment (Entity)

- Type of Industry

Type of Item

Some items would be tax exempt in one state. But this would not necessarily be the same in another state. Similarly, a state government may impose a higher or lower tax rate based on the type of an item.

Combination of Customer Type and Item Type

In some states, an item may qualify for much lower tax rate when sold to a certain industry or corporation type, while remaining the same for all other cases.

Remember

- It is advised that you understand the tax requirement of your state government, including your nexus state governments. Please consult with a professional or even the state governments for more information about your tax requirement.

- In MixERP, you must configure state sales tax information for all states you operate in, including your nexus presence.

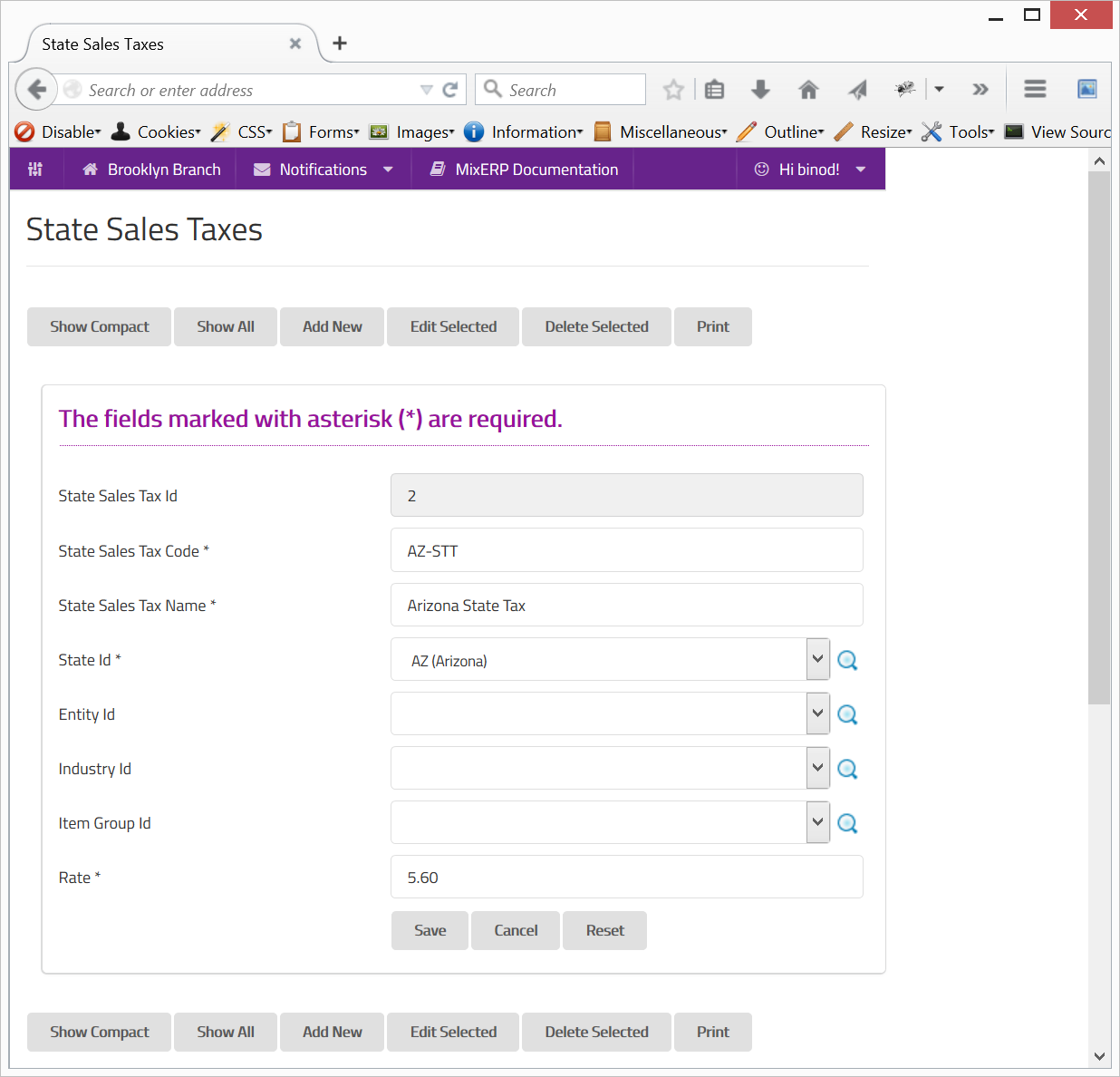

Fields

State Sales Tax Id

This is an auto-generated and read-only field.

State Sales Tax Code

Provide a unique code for the state sales tax.

State Sales Tax Name

Provide a name for the state sales tax.

State Id

Select the state or search by clicking the icon .

Entity Id

Select the entity or search by clicking the icon .

Industry Id

Select the entity or search by clicking the icon .

Item Group Id

Select the entity or search by clicking the icon .

Rate

Enter the tax rate in percentage.