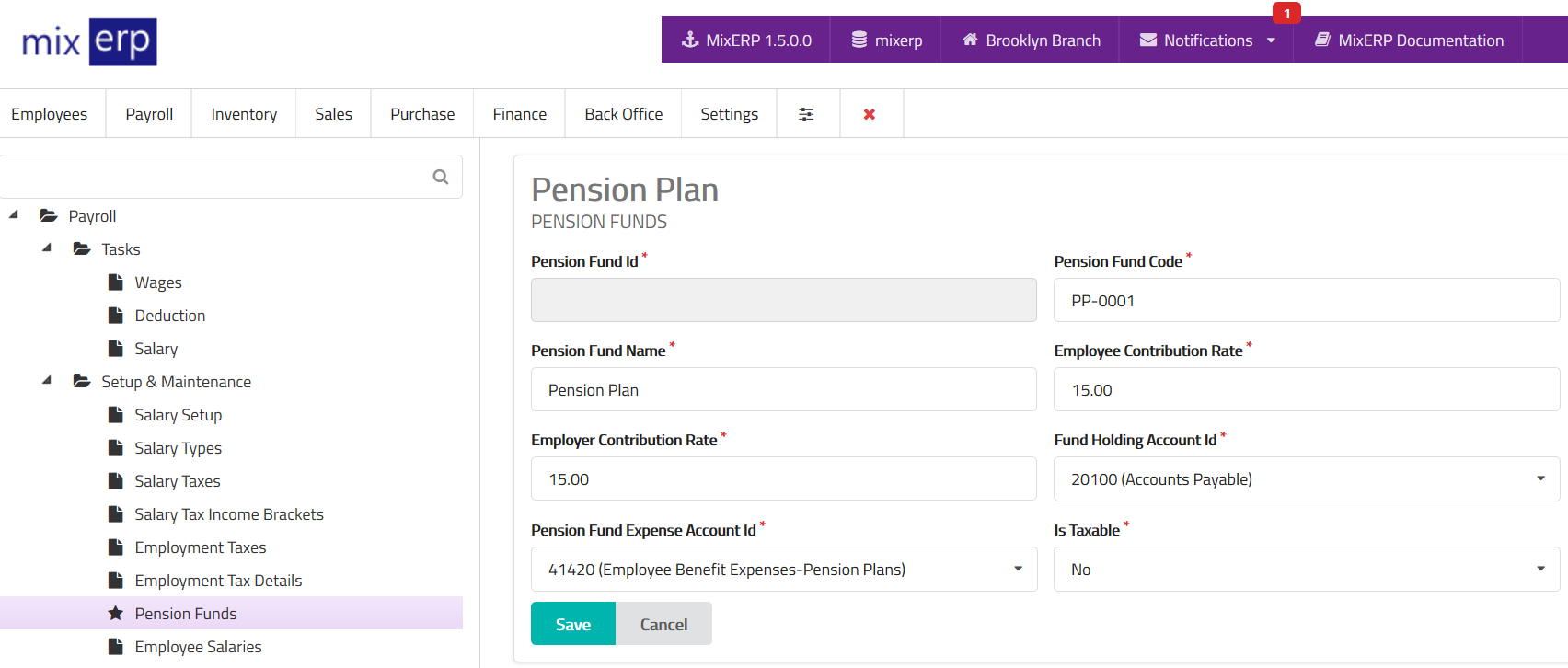

Pension Funds

| Pension Fund Id | This will be automatically generated. |

|---|---|

| Pension Fund Code | Enter an alpha-numeric code for this pension fund. |

| Pension Fund Name | Enter the pension fund name. |

| Employee Contribution Rate | Enter the rate without the percent (%) symbol which will be deducted from salary and posted to pension fund holding account. |

| Employer Contribution Rate | Enter the rate without the percent (%) symbol which will be posted to pension fund holding account at an expense of the employer. |

| Fund Holding Account Id | Select a liability account from the list. This account will hold pension fund transactions. |

| Pension Fund Expense Account Id | Select an expense account from the list which will be used to debit employer contribution of this pension fund. |

| Is Taxable | State whether or not the deductions related to this pension fund are taxable. If you specify this pension fund as taxable, the deductions will appear after taxable salary items. Whereas nontaxable deductions will appear along with the taxable salary item, thus reducing the total taxable earnings. |