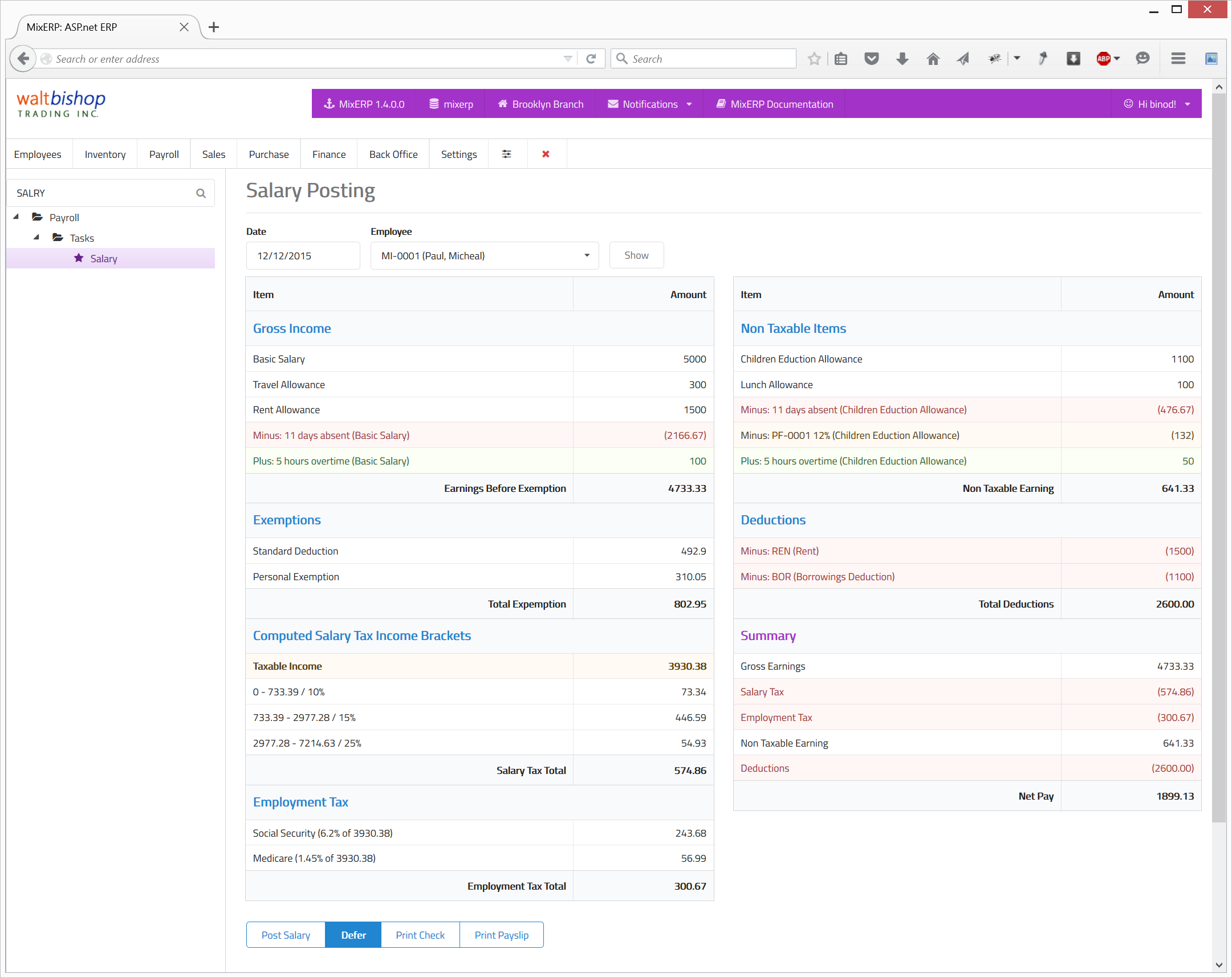

Salary Posting

Select an employee and the date of salary. Click the show button.

| Earnings Before Exemption | This includes all taxable salary items. Depending on how you configured each salary item, absenteeism deduction and/or overtime addition may appear here. Similarly, non taxable pension fund items may also appear here. |

|---|---|

| Exemptions | Exemptions, if applicable to your country, will appear here. For example, the United States Government provides exemptions depending on your filing status (standard deduction) and number of your dependents (personal exemption). |

| Taxable Income | Taxable income means total taxable earnings minus all applicable exemptions. |

| Salary Tax | Salary tax is computed against income brackets. The income brackets are converted from year to whatever you have in salary setup frequency. |

| Employment Tax | Not only employment tax is deducted from the employee's salary, but also the employer needs to make an additional expense entries. Currently, there are two employment taxes in the United States:

|

| Non Taxable Earning | This includes all non taxable salary items. Depending on how you configured each salary item, absenteeism deduction and/or overtime addition may appear here. Similarly, taxable pension fund items may also appear here. |

| Deductions | This includes deduction items related to this employee. |

| Net Pay | Net pay is the net amount earned by the employee after all taxes and deductions. MixERP, being a full-fledged accounting and payroll management software, posts each individual payroll items during GL posting instead of merely posting just the net pay. |