Tax Authorities

A tax authority is a government body or agency to whom you need to file tax reports to. In United States, you may need to create several tax authorities, which may include:

- State Authority

- County Authority

- Local Authority

- Other

You may be required to create and report to additional authorities if your business has presence in another state(s) even if you don't directly operate there, which is known as nexus compliance. Please refer to the following articles (external domain) for more information:

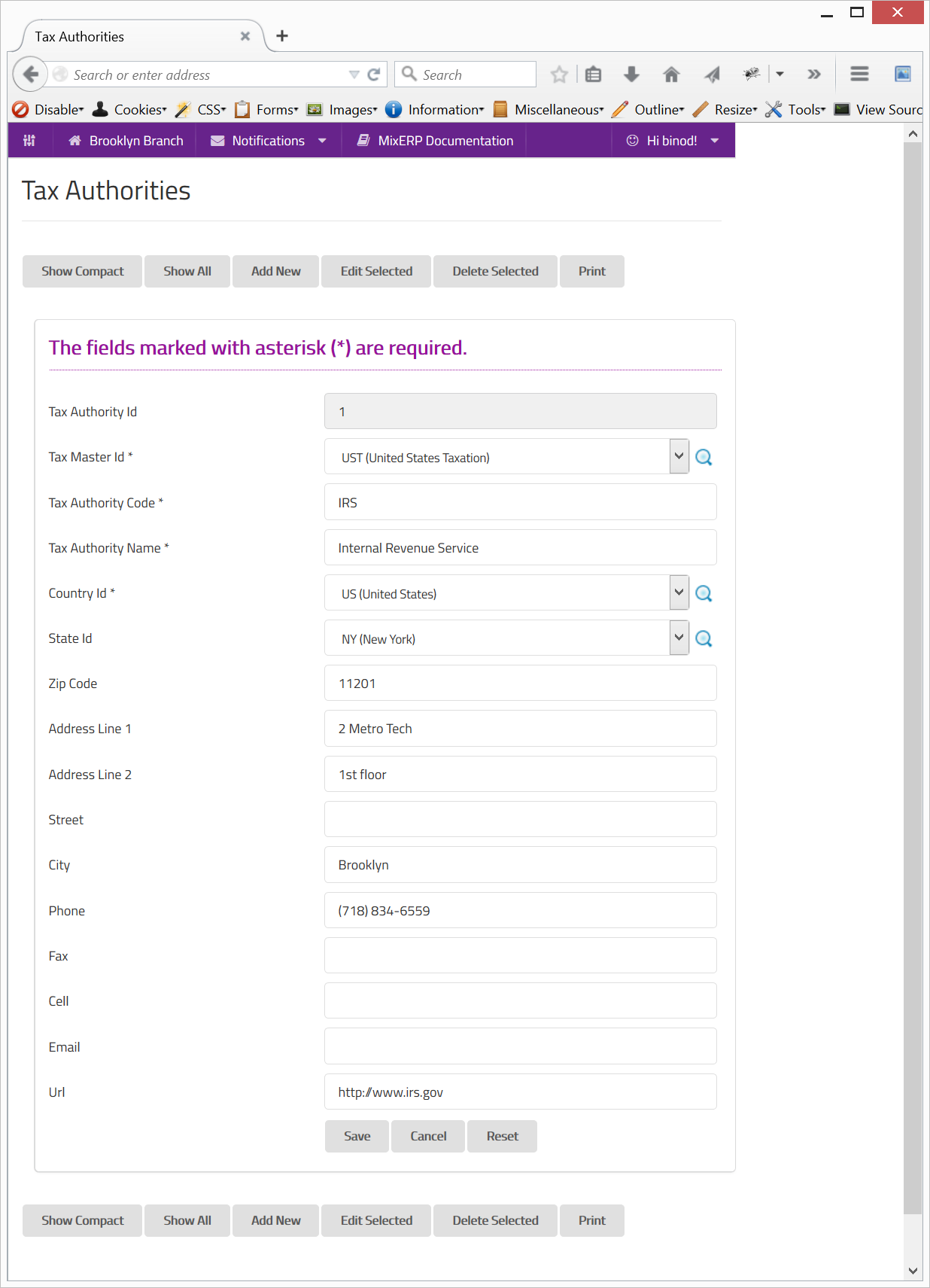

Fields

Tax Autority Id

This is an auto-generated and read-only field.

Tax Master Id

Select the tax master or search by clicking the icon .

Tax Authority Code

Provide a unique code for the tax authority.

Tax Authority Code

Provide a name for the tax authority.

Country Id

Select the country of the tax authority or search by clicking the icon .

State Id

Select the state of the tax authority or search by clicking the icon .

ZIP Code

Enter the ZIP code of the tax authority.

Address Line 1, Address Line 2, Street, City

Provide the address for the tax authority in the respective fields.

Phone

Enter the phone number(s) of the tax authority here. You can provide several numbers here, separated with commas.

Fax

Enter the fax number(s) of the tax authority.

Cell

Enter the cell number(s) of the relationship officer(s) of the tax authority.

Enter the email address(es) of the tax authority.

URL

Enter the website URL of the tax authority.