Odoo's tax engine is very flexible and support many different type of taxes: value added taxes (VAT), eco-taxes, federal/states/city taxes, retention, withholding taxes, etc. For most countries, your system is pre-configured with the right taxes.

Esta sección detalla como definir nuevos impuestos para casos de uso específicos.

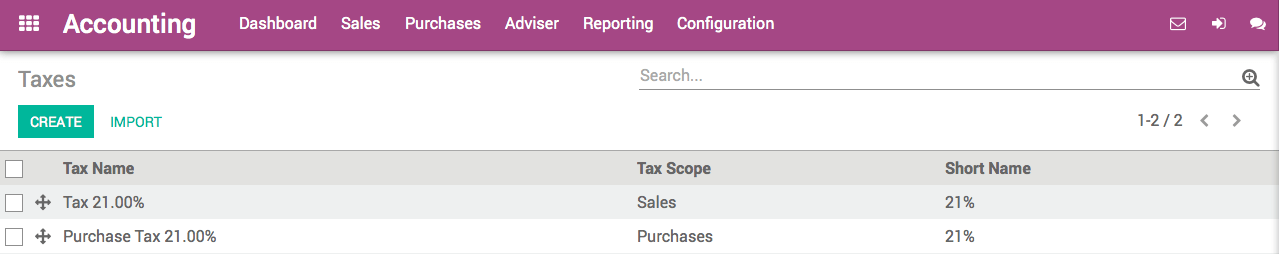

- Go to . From this menu, you get all the taxes you can use: sales taxes and purchase taxes.

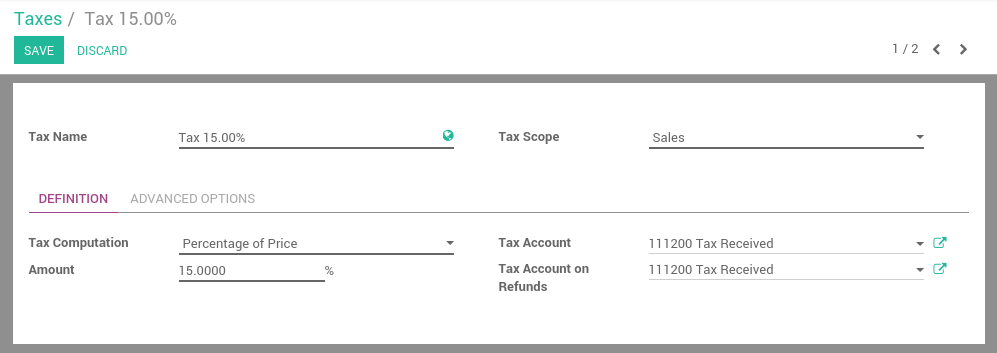

- Choose a scope: Sales, Purchase or None (e.g. deprecated tax).

Select a computation method:

- Fixed: eco-taxes, etc.

- Percentage of Price: most common (e.g. 15% sales tax)

- Percentage of Price Tax Included: used in Brazil, etc.

Grupo de impuestos: permite tener un impuesto compuesto

- If you use Odoo Accounting, set a tax account (i.e. where the tax journal item will be posted). This field is optional, if you keep it empty, Odoo posts the tax journal item in the income account.

Truco

If you want to avoid using a tax, you can not delete it because the tax is probably used in several invoices. So, in order to avoid users to continue using this tax, you should set the field Tax Scope to None.

Nota

If you need more advanced tax mechanism, you can install the module account_tax_python and you will be able to define new taxes with Python code.

Advanced configuration

- Label on Invoices: a short text on how you want this tax to be printed on invoice line. For example, a tax named "15% on Services" can have the following label on invoice "15%".

Grupo de Impuestos: define donde este impuesto es resumido en el pie de página de la factura. Todos los impuestos que pertenecen al mismo grupo de impuestos serán agrupados en el pie de página de la factura. Ejemplos de grupo de impuestos: IVA, Retención.

Incluir en Costo Analítico: el impuesto es contado como un costo y, así, genera una entrada analítica si su factura usa cuentas analíticas.

- Tags: are used for custom reports. Usually, you can keep this field empty.

Ver también

aplicación- How to set tax-included prices