Introducción

La facturación electrónica para Colombia está disponible en Odoo 12 y requiere los siguientes módulos:

l11n_co: Todos los datos básicos para administrar el módulo de contabilidad, contiene la configuración por defecto para: plan de cuentas, impuestos, retenciones, identificaciones y tipos de documentos.

l10n_co_edi: Este módulo incluye todos los campos extra que se requieren para la inntegración con Carvajal T&S y generar la facturación electrónica, basada en los requerimientos legales de DIAN.

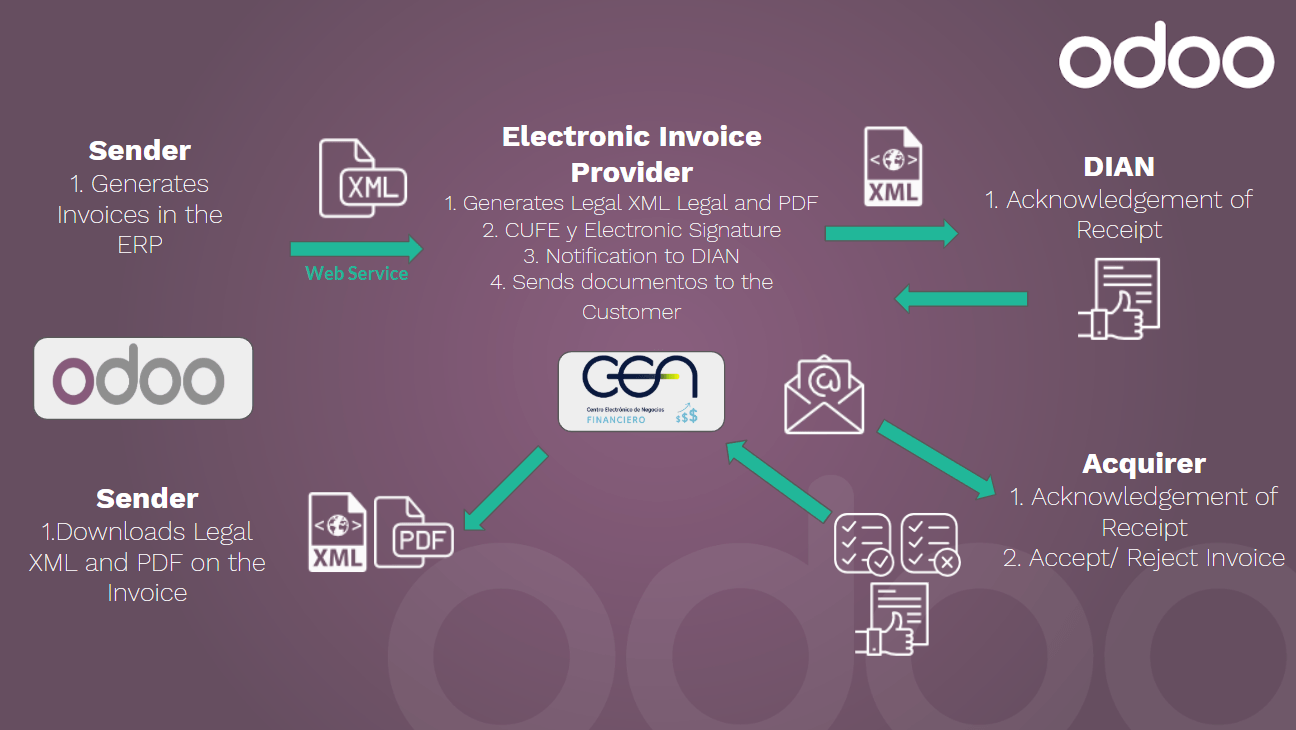

Flujo

Configuración

1. Install the Colombian localization modules

Para hacerlo, vaya a Aplicaciones y busque “Colombia”. Haga click en “Instalar” para los primeros dos módulos.

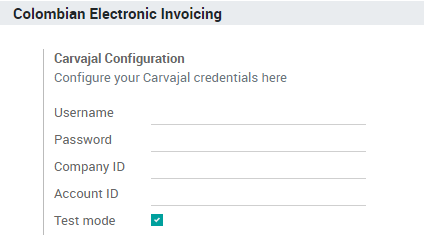

2. Configure credentials for Carvajal T&S web service

Una vez que los módulos sean instalados, para estar habilitado a conectarse con el webservice Carvajal T&S, es necesario configurar las credenciales de usuario. Esta información será provista por Carvajal T&S.

Ir a y busque la sección Facturación Electrónica para Colombia.

Utilizando el modo de Test es posible conectarse al entorno de pruebas de Carvajal T&S. Esto permite a los usuarios probar el flujo commpleto y la integración conn el portal financiero CEN, el cual está accesible aquí: https://cenfinancierolab.cen.biz

Una vez que Odoo y Carvajal T&S estén completamente configurados y listos para producción, el entorno de test puede ser deshabilitado.

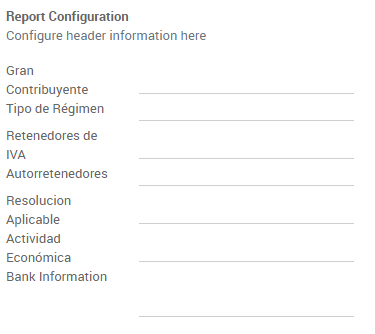

3. Configure your report data

Como parte de la información configurable que es enviada en el XML, Ud. puede definir los datos para la sección fiscal y la información bancaria en el PDF.

Ir a y busque la sección Facturación Electrónica para Colombia.

4. Configure data required in the XML

4.1 Cliente

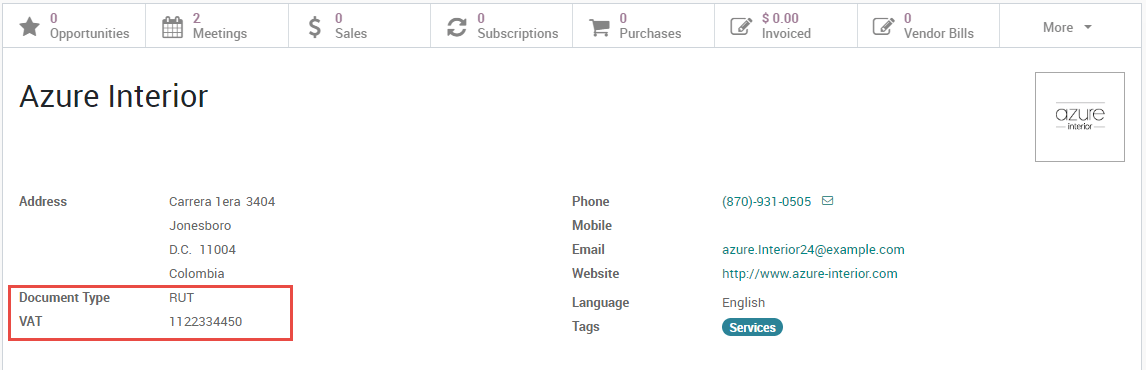

4.1.1. Identificación

Como parte de la localización colombiana, los tipos de docuemntos definidos por el DIAN están ahora disponibles en el formulario del Cliente. Los clientes colombianos deben tener su número de identificación y tipo de documento configurados.

Truco

Cuando el tipo de documento es RUT, el número de identificación necesita ser configurado en Odoo incluyendo el dígito verificador, Odoo dividirá este número cuando los datos sean enviados al proveedor.

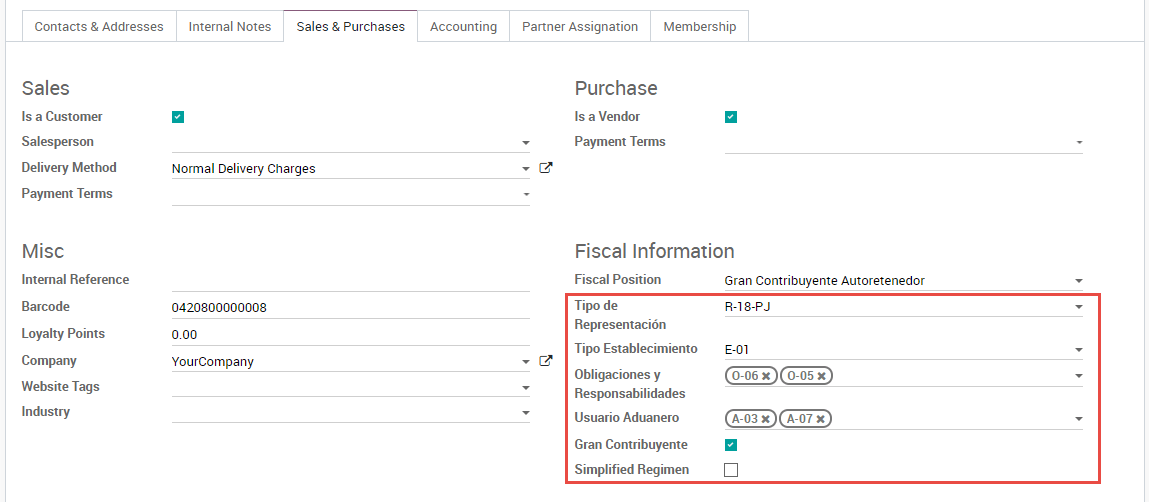

4.1.2. Estructura fiscal (RUT)

Los códigos de responsabilidad del Cliente (sección 53 en el documento RUT) sonn incluídas como parte del módulo de facturación electrónica, debido a que es parte de la información requerida por el DIAN.

These fields can be found in

Additionally two booleans fields were added in order to specify the fiscal regimen of the partner.

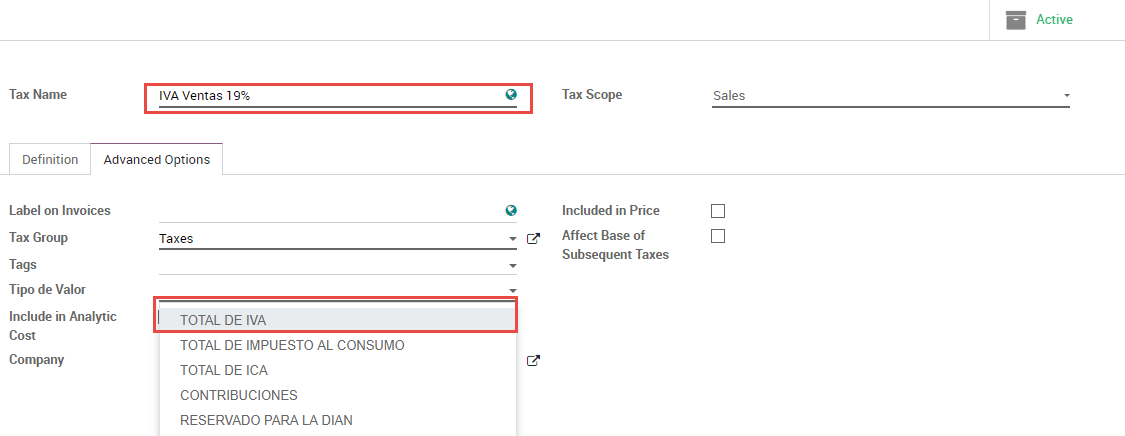

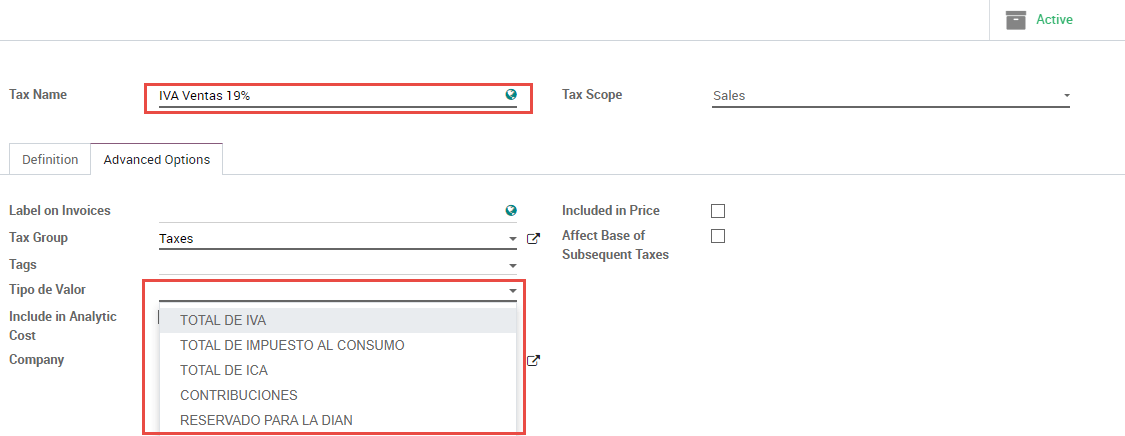

4.2 Taxes

If your sales transactions include products with taxes, it's important to consider that an extra field Value Type needs to be configured per tax. This option is located in the Advanced Options tab.

Retention tax types (ICA, IVA, Fuente) are also included in the options to configure your taxes. This configuration is used in order to correctly display taxes in the invoice PDF.

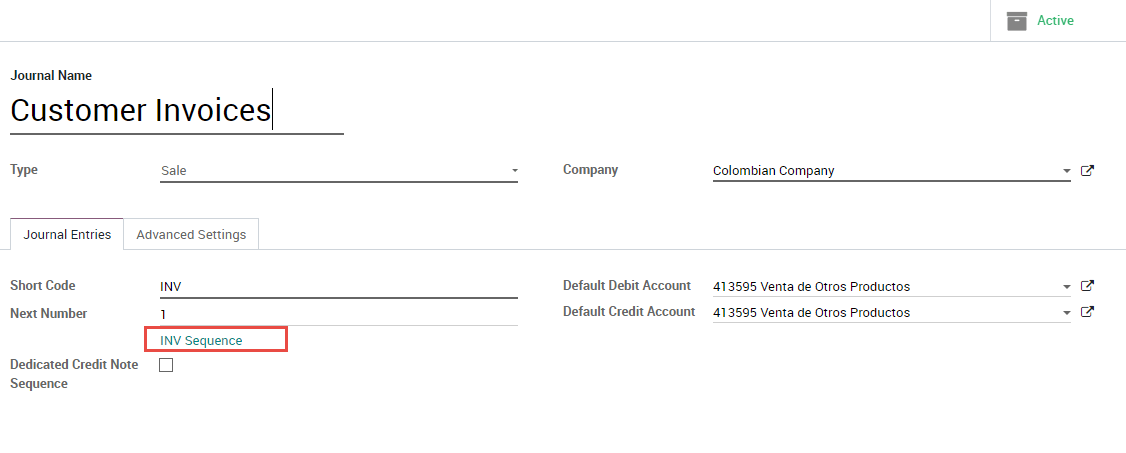

4.3 Journals

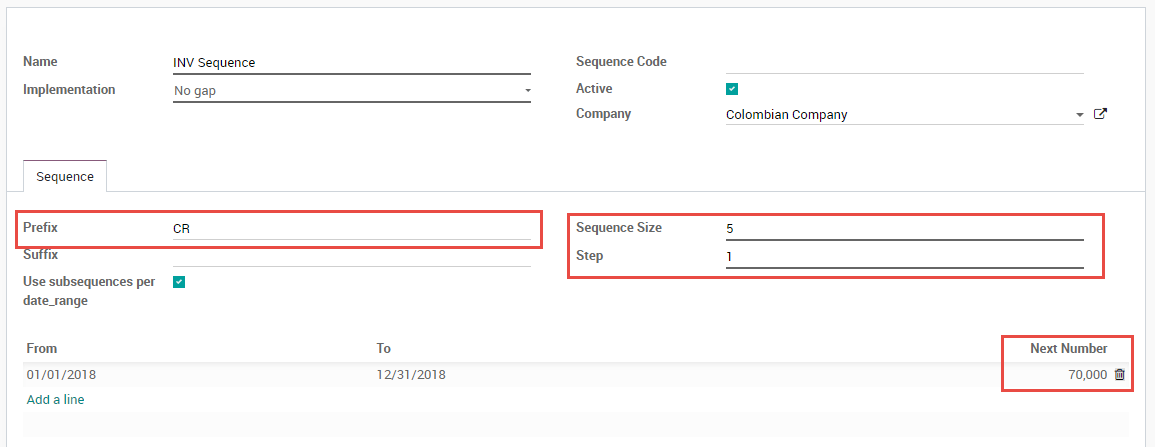

Once the DIAN has assigned the official sequence and prefix for the electronic invoice resolution, the Sales journals related to your invoice documents need to be updated in Odoo. The sequence can be accessed using developer mode: .

Once that the sequence is opened, the Prefix and Next Number fields should be configured and synchronized with the CEN Financiero.

4.4 Users

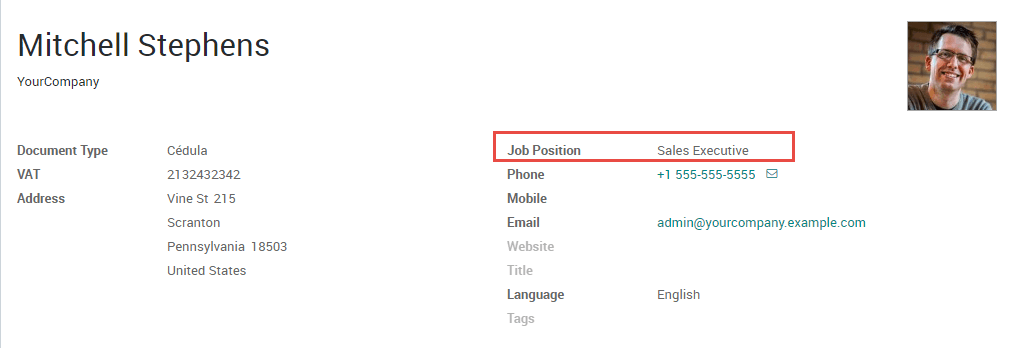

The default template that is used by Odoo on the invoice PDF includes the job position of the salesperson, so these fields should be configured:

Usage and testing

1. Invoice

When all your master data and credentials has been configured, it's possible to start testing the electronic invoice workflow.

1.1 Invoice creation

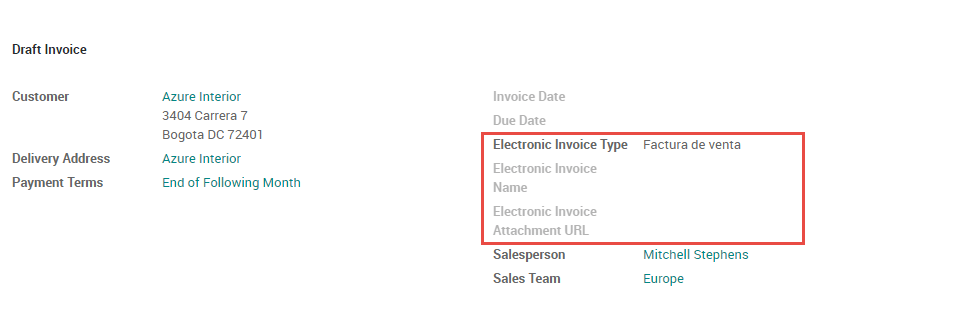

The functional workflow that takes place before an invoice validation doesn't change. The main changes that are introduced with the electronic invoice are the next fields:

There are three types of documents:

- Factura Electronica: This is the regular type of document and its applicable for Invoices, Credit Notes and Debit Notes.

- Factura de Importación: This should be selected for importation transactions.

- Factura de contingencia: This is an exceptional type that is used as a manual backup in case that the company is not able to use the ERP and it's necessary to generate the invoice manually, when this invoice is added to the ERP, this invoice type should be selected.

1.2 Invoice validation

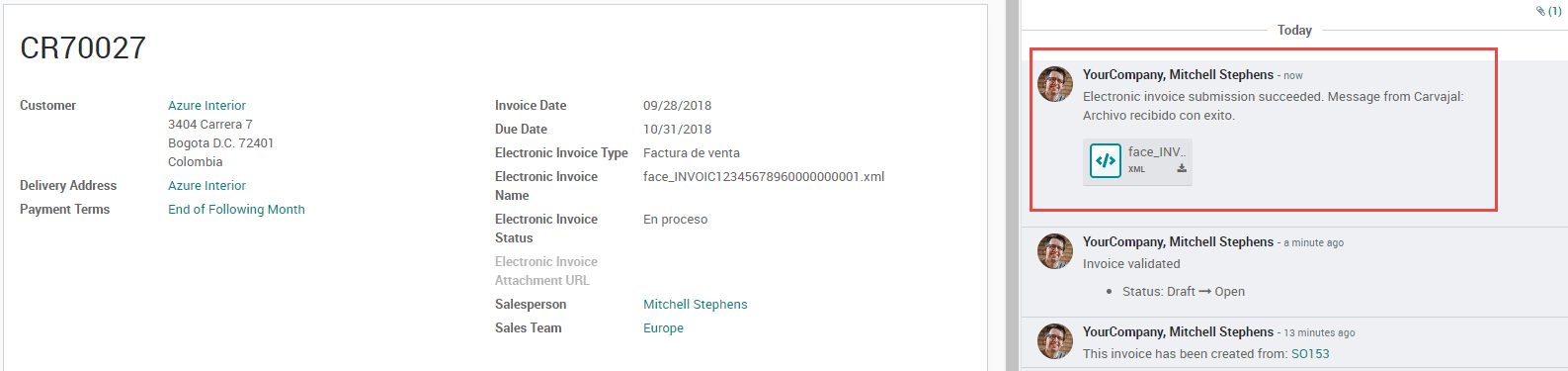

After the invoice is validated an XML file is created and sent automatically to Carvajal, this file is displayed in the chatter.

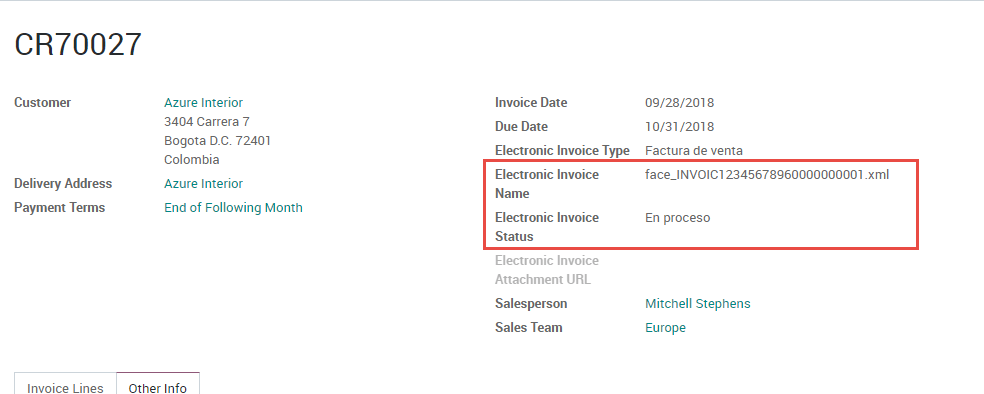

An extra field is now displayed in "Other Info" tab with the name of the XML file. Additionally there is a second extra field that is displayed with the Electronic Invoice status, with the initial value "In progress":

1.3 Reception of legal XML and PDF

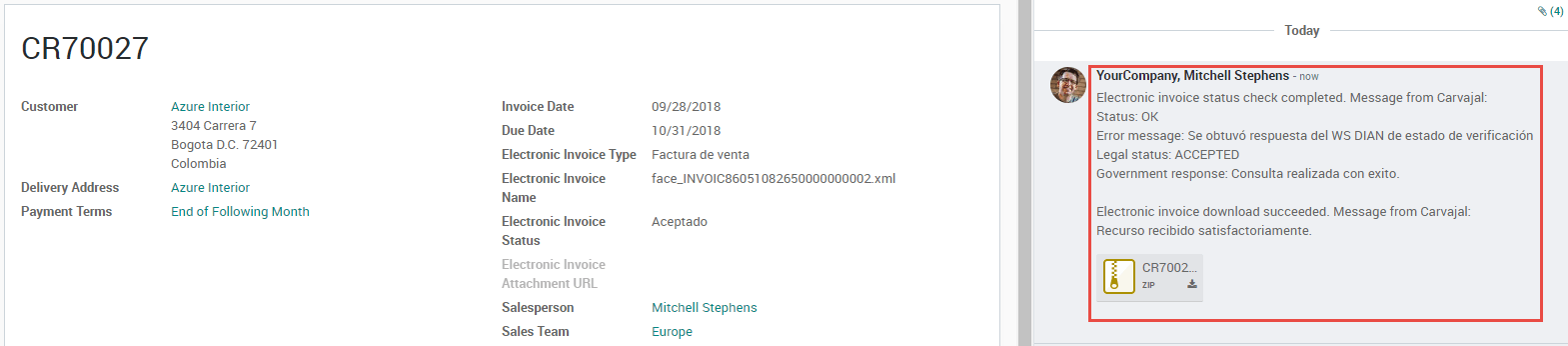

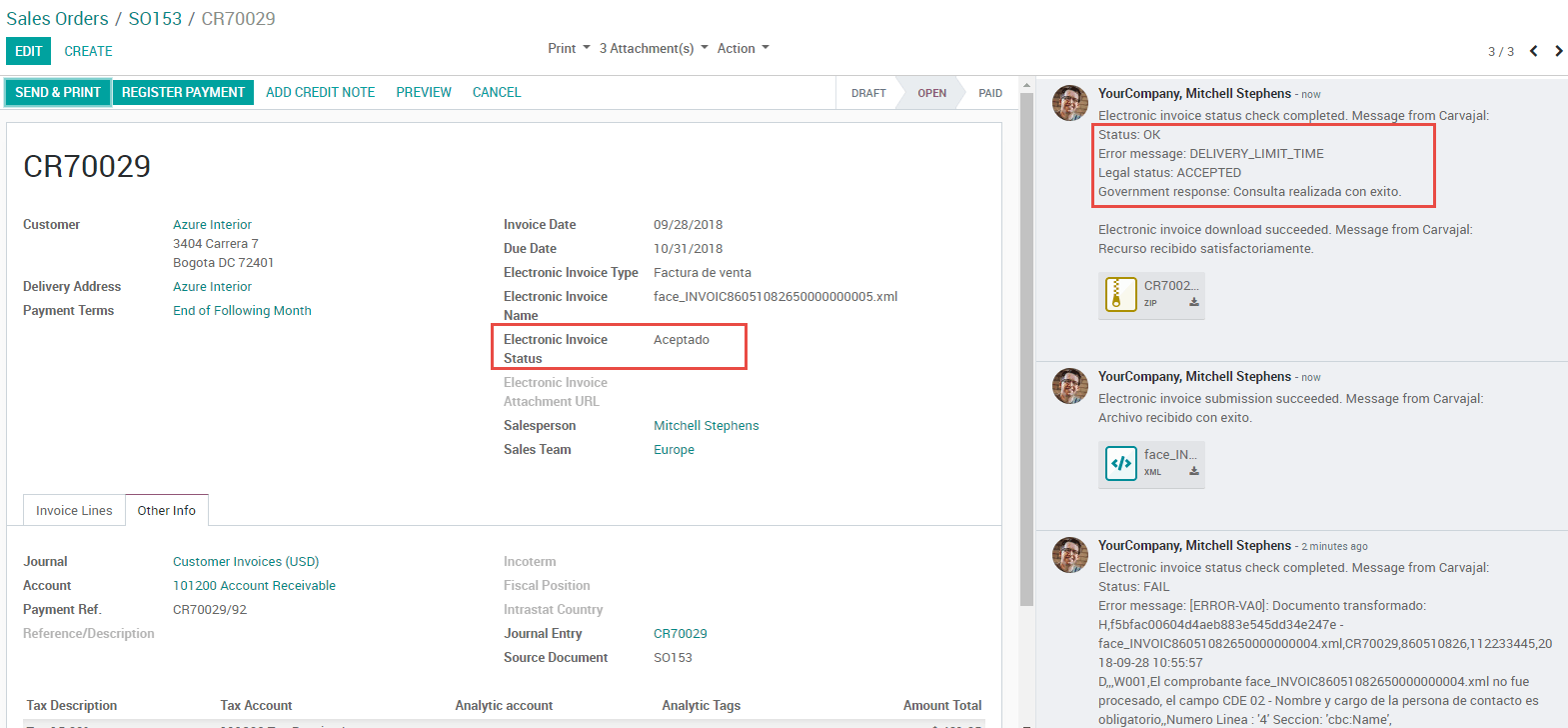

The electronic invoice vendor receives the XML file and proceeds to validate the structure and the information in it, if everything is correct the invoice status changes to "Validated" after using the "Check Carvajal Status" button in the Action dropdown. They then proceed to generate a Legal XML which includes a digital signature and a unique code (CUFE), a PDF invoice that includes a QR code and the CUFE is also generated.

After this:

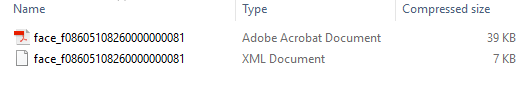

- A ZIP containing the legal XML and the PDF is downloaded and displayed in the invoice chatter:

- The Electronic Invoice status changes to "Accepted"

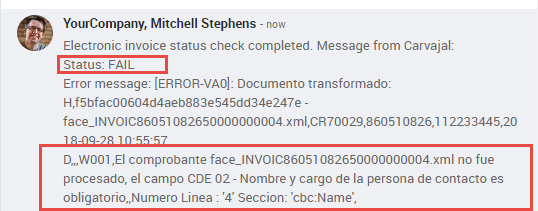

1.4 Common errors

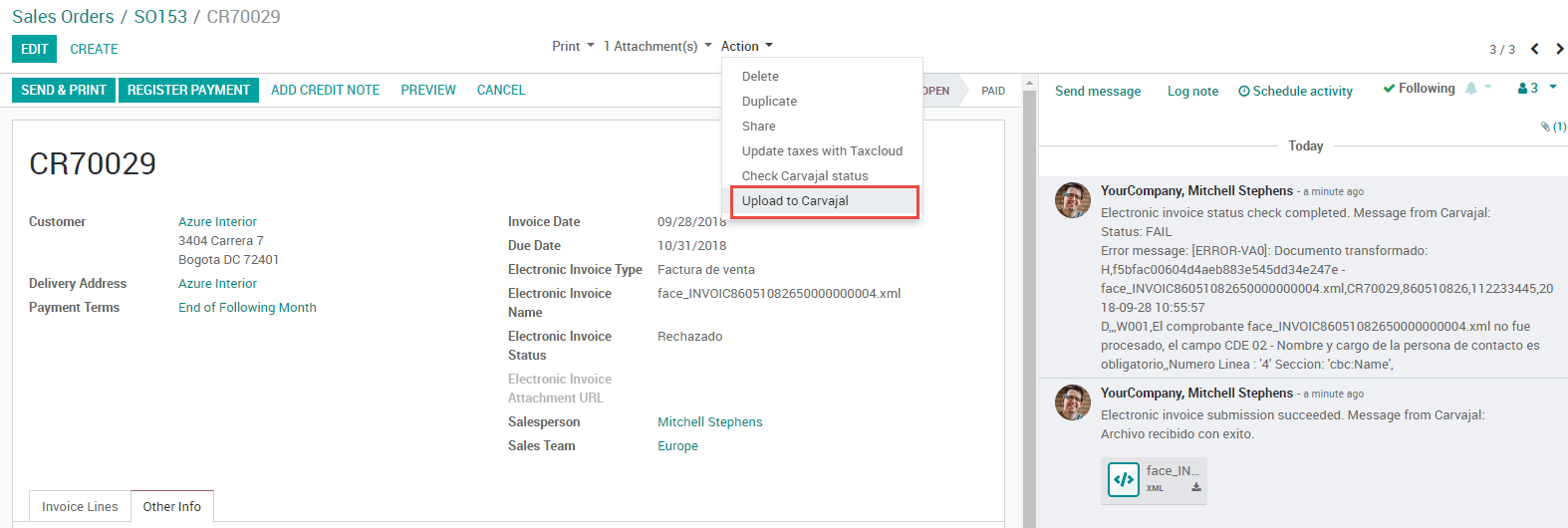

During the XML validation the most common errors are usually related to missing master data. In such cases, error messages are shown in the chatter after updating the electronic invoice status.

After the master data is corrected, it's possible to reprocess the XML with the new data and send the updated version, using the following button:

2. Additional use cases

The process for credit and debit notes is exactly the same as the invoice, the functional workflow remains the same as well.