Expense Categories are used to identify the General Ledger (G/L) Accounts to be used when processing the following:

Non-Inventory Purchase Order Items

Miscellaneous Vouchers

Miscellaneous A/P Checks

Expense Transactions

For example, when entering a Purchase Order for a non-Inventory Item, you must select an Expense Category—thereby identifying the G/L Accounts the purchasing transaction will be distributed to. To access the master list of Expense Categories, select the "Expense Categories" option. The following screen will appear:

The "Expense Categories" screen displays information on all existing Expense Categories, including Expense Category code and Expense Category description.

To the far right of the screen, the following buttons are available:

- CLOSE

Closes the screen, returning you to the application desktop.

Runs the report associated with this screen.

- NEW

Opens screen for creating a new Expense Category.

- EDIT

Enables you to edit highlighted Expense Categories. The edit screen is the same as that for creating a new Expense Category—except that when editing, the fields will contain Expense Category information. Double-clicking on an Expense Category will also bring you to the editing screen.

- VIEW

Highlight an Expense Category and then select this button to reach a read-only view of the "Edit" screen.

- COPY

Highlight an Expense Category and then select this button to reach a screen for copying the Expense Category master.

- DELETE

Highlight an Expense Category and then select this button to remove the category from the list.

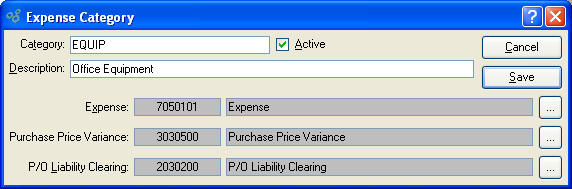

To create a new Expense Category, select the NEW button. The following screen will appear:

When creating a new Expense Category, you are presented with the following options:

- Category

Enter the Expense Category name.

- Description

Enter a brief description of the Expense Category.

- Active

Select to show the Expense Category as active. Not selecting means the Expense Category will be considered inactive. To re-activate an Expense Category, simply select this option.

- Expense

Identify a General Ledger (G/L) Account to distribute Purchasing Expenses to. This is an Expense Account. It will be debited when transactions using Expense Categories are posted.

- Purchase Price Variance

Identify a General Ledger (G/L) Account to distribute purchase Price variances to. This is an Asset Account. It will be credited or debited with the value of any variance that may arise when a Voucher is posted for non-Inventory Items.

- P/O Liability Clearing

Identify a General Ledger (G/L) Account to distribute Purchase Order liability clearing to. This is a Liability Account. It will be credited when non-Inventory Items are received, and debited when a Voucher for these Items is posted.

To the far right of the screen, the following buttons are available:

- CANCEL

Closes the screen without creating an Expense Category, returning you to the previous screen.

- SAVE

Creates the Expense Category and adds it to the master list of Expense Categories.