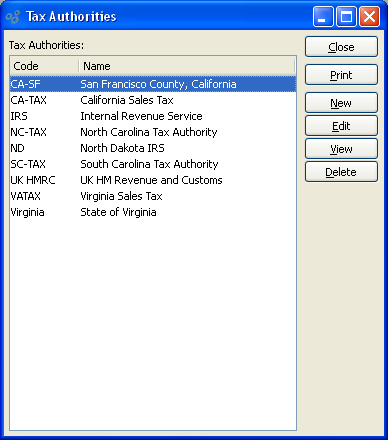

Tax Authorities are any entities legally-authorized to collect Taxes—for example, city, county, state, or federal government agencies. To access the master list of Tax Authorities, select the "Tax Authorities" option. The following screen will appear:

The "Tax Authorities" screen displays information on all existing Tax Authorities, including Tax Authority code and Tax Authority name.

To the far right of the list, the following buttons are available:

- CLOSE

Closes the screen, returning you to the application desktop.

Runs the report associated with this screen.

- NEW

Opens screen for creating a new Tax Authority.

- EDIT

Enables you to edit highlighted Tax Authorities. The edit screen is the same as that for creating a new Tax Authority—except that when editing, the fields will contain Tax Authority information. Double-clicking on a Tax Authority will also bring you to the editing screen.

- VIEW

Highlight a Tax Authority and then select this button to reach a read-only view of the "Edit" screen.

- DELETE

Highlight a Tax Authority and then select this button to remove the Tax Authority from the list.

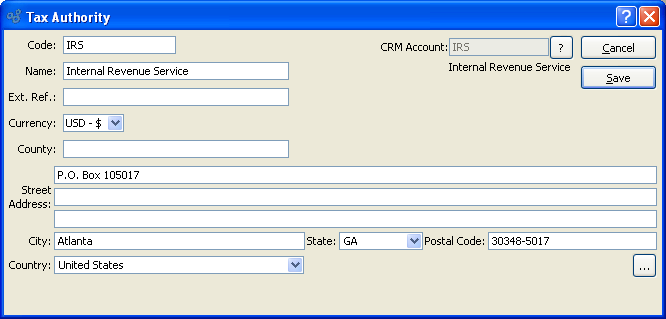

To create a new Tax Authority, select the NEW button. The following screen will appear:

When creating a new Tax Authority, you are presented with the following options:

- Code

Enter a code to identify the Tax Authority.

- Name

Enter a name to describe the Tax Authority.

- CRM Account

-

Displays the CRM Account Number associated with the Tax Authority.

Tax Authorities are a form of CRM Account. If a Tax Authority is created from the Accounting module, a linked CRM Account will automatically be created. To view the CRM Account information for the Tax Authority, select the "?" symbol next to the field.

- Ext. Ref

Use this field to record any external accounting references for the Tax Authority—if applicable.

- Currency

-

Specify the Currency to be used for Tax calculations when transactions are governed by the Tax Authority.

The Currency selection affects only Tax calculations for transactions governed by the Tax Authority. It has no impact on the Currency used for Line Items, etc. on an Order. If the Tax Authority requires Tax to be collected in the base Currency, then do not make a selection; leave this field blank. This option won"t even be available if your site does not have multiple Currencies defined.

Tip

If a Tax Authority collects Tax in your base Currency, then leave the Currency selection blank.

- County

Enter the County which the Tax Authority has jurisdiction over—if applicable.

- Address

-

Manually enter Tax Authority's Address information in the fields below—or use the browse button to select pre-existing Address information.

Street Address: Enter the street Address for the Tax Authority.

City: Enter the city where the Contact is Tax Authority.

State: Enter the state where the Contact is Tax Authority.

Postal Code: Enter the Postal Code for the Tax Authority.

Country: Enter the country where the Tax Authority is located.

To the far right of the screen, the following buttons are available:

- CANCEL

Closes the screen without creating a Tax Authority, returning you to the previous screen.

- SAVE

Creates the Tax Authority and adds it to the master list of Tax Authorities.