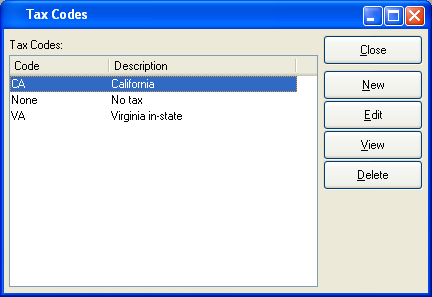

Tax Codes define the amount and type(s) of Tax to be added to an Order. To access the master list of Tax Codes, select the "Tax Codes" option. The following screen will appear:

The Tax Codes master list displays the code and description for all existing Tax Codes.

To the far right of the screen, the following buttons are available:

- CLOSE

Closes the screen, returning you to the application desktop.

- NEW

Opens screen for creating a new Tax Code.

- EDIT

Enables you to edit highlighted Tax Code. The edit screen is the same as that for creating a new Tax Code—except that when editing, the fields will contain Tax Code information. Double-clicking on a Tax Code will also bring you to the editing screen.

- VIEW

Highlight a Tax Code and then select this button to reach a read-only view of the "Edit" screen.

- DELETE

Highlight a Tax Code and then select this button to remove the Tax Code from the master list

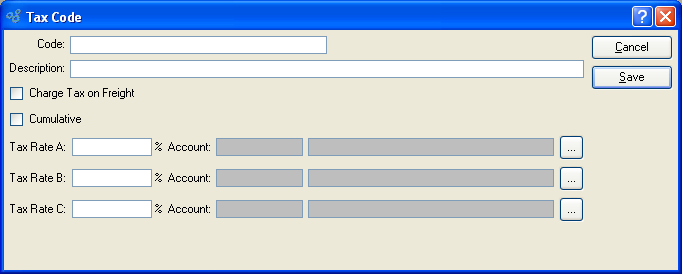

To create a new Tax Code, select the NEW button. The following screen will appear:

When creating a new Tax Code, you are presented with the following options:

- Code

Enter an identifying code for the Tax Code.

- Description

Enter a description to identify the Tax Code.

- Charge Tax on Freight

Select to charge Tax on top of any freight charges. If not selected, freight charges will not be taxed.

- Cumulative

-

Select if you want Tax Rates to be applied on top of previously applied Taxes.

This option pertains only to Tax Rates B and C. Tax Rate A is always applied directly to the Line Item subtotal. The following equations illustrate how Tax Rates are applied if the "Cumulative" option is selected:

Tax Rate A amount = A% x subtotal

Tax Rate B amount = B% x (subtotal + Tax Rate A amount)

Tax Rate C amount =C% x (subtotal + Tax Rate A amount + Tax Rate B amount)

Note

The "Cumulative" option is not likely to apply to taxing jurisdictions within the United States.

- Tax Rate A

Enter a Tax Rate percentage to be applied to the Line Item subtotal. Tax Rate A cannot be cumulative. By definition, it is always applied to the Line Item subtotal.

- Account

Specify a valid General Ledger Account. This is a Revenue Account. It will be credited when Invoices using Tax Rate A are posted and debited when Credit Memos using Tax Rate A are posted.

Tip

You must enter a Tax Rate greater than "0" to ensure Account Number information is saved. If the Tax Rate = 0, then no Account information will be saved.

- Tax Rate B

Enter a Tax Rate percentage to be applied to either the Line Item subtotal or the cumulative total. For Tax Rate B calculations to be cumulative, the "Cumulative" option must be selected.

- Account

Specify a valid General Ledger Account. This is a Revenue Account. It will be credited when Invoices using Tax Rate B are posted and debited when Credit Memos using Tax Rate B are posted.

- Tax Rate C

Enter a Tax Rate percentage to be applied to either the Line Item subtotal or the cumulative total. For Tax Rate C calculations to be cumulative, the "Cumulative" option must be selected.

- Account

Specify a valid General Ledger Account. This is a Revenue Account. It will be credited when Invoices using Tax Rate C are posted and debited when Credit Memos using Tax Rate C are posted.

To the far right of the screen, the following buttons are available:

- CANCEL

Closes the screen without creating a Tax Code, returning you to the application desktop.

- SAVE

Creates the Tax Code and adds it to the master list of Tax Codes.