Many users of xTuple ERP have a company policy to accept returned goods. To adequately handle this situation they need a mechanism to keep a record of what goods have been authorized for a return, credit, or other disposition. A Return Authorization is an internal approval system to resolve a problem resulting from dissatisfaction with products or services shipped. Depending on the business model, users may handle the return in a number of ways. The xTuple ERP return system is flexible enough to handle the needs of most business scenarios.

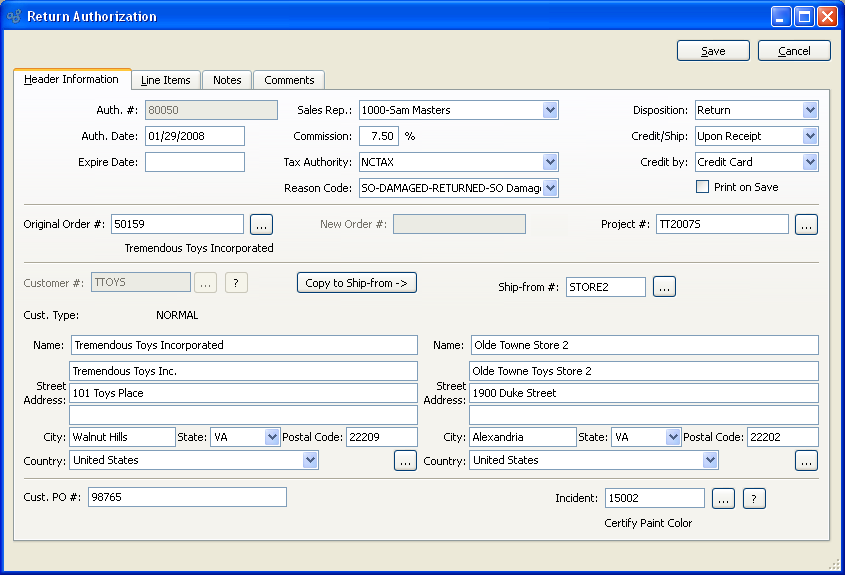

To access the Return Authorization window, Return Authorizations must be enabled in Sales Configuration. A Return Authorization appears as follows:

When creating a new Return Authorization, you are presented with the following options:

- Auth #

Next available Return Authorization Number will automatically display, unless your system requires you to enter Return Authorization Numbers manually. Default values and input parameters for Return Authorization Numbers are configurable at the system level.

- Auth. Date

Displays current day's date.

- Expire Date

Specify the date when the Return Authorization will expire. This is an optional setting used to determine the amount of time that should pass before the transactions on the Return Authorization are considered past due

- Sales Rep.

Specify the Sales Representative associated with the Return Authorization. Sales Representatives are linked to a Customer on the Customer master—either by a default setting or through the assignment of Ship-To Addresses. Each Ship-To Address may have a different Sales Representative associated with it. Consequently, the name of the Sales Representative appearing on the Return Authorization header will be the same as specified for the Ship-To Address being used.

- Commission

By default, the commission percentage recorded on the Customer master will be automatically entered in this field. If for some reason you select a non-default Sales Representative, the commission rate will not change. To adjust the commission rate, you must make the change manually.

- Tax Authority

Specify the Tax Authority associated with the Return Authorization. The Tax Authority for the specified Ship-To Address will be entered here by default. Otherwise, the primary Tax Authority for the Customer will be entered. Ultimately, Tax is applied at the Line Item level—so the Tax Authority associated with an Item's Tax Type will be used.

- Reason Code

Specify the reason for the Return Authorization. Reason Codes are used to explain why a Customer return is being authorized.

- Disposition

-

Specify the method to be used for handling the Return Authorization. If your system is configured to use a default disposition, then that value will be shown.

Note

The disposition of individual Line Items will be determined conditionally based on the settings made at the Return Authorization header level.

- Credit

Select to authorize the issuing of credit to the specified Customer. No return is required or expected; as a result, the Credit/Ship timetable option will be disabled for this disposition method. Return Authorization Line Items will close when an associated Credit Memo is posted.

- Return

Select to authorize returns from the specified Customer. Return Authorization Items will close when an associated Credit Memo is posted, or when all Items on a line have been returned, whichever comes last.

- Replace

Select to authorize the replacement of Items returned by the specified Customer. Authorized quantities will be added as additional order quantity to a new associated Sales Order. Return Authorization Items will close when all Items on the line have been returned or all authorized Items on the line have been shipped, whichever comes last. Any money to be credited to the customer is set on the Return Authorization line; any money to be billed to the customer is set at the new sales order line.

- Service

Select to authorize the repair or service of Items returned by the specified Customer. To isolate costing implications, only Items of type Job may be selected. Service or repair items will first be received by the Return Authorization. A new Sales Order with linked Work Order(s) will be created to track work and shipping on the repair or service. Money to be billed for service or repair should be set at the New Sales Order.

- Substitute

Select to authorize the substitution of Items returned by the specified Customer. Under this option, when an original Sales Order is imported into the Return Authorization, the Return Authorization Line Items will default to the Return disposition. Any new Line Items added beyond the original ones will have a default disposition of Ship.

- Credit/Ship

-

Specify the timing for the Return Authorization:

- Immediately

Select to issue credit or send returns to the specified Customer immediately.

- Upon Receipt

Select to issue credit or ship new associated Sales Order items only after you have received the returned goods.

- Credit by

-

Specify the method to be used for crediting the Customer:

- None

Select if you will not be issuing credit to the Customer. If you select this option, you will be unable to add pricing information at the Return Authorization Line Item level.

- Credit Memo

Select to credit the return with a Credit Memo to the Customer's account. If selected, a sales Credit Memo will be automatically queued up for processing on the Return Authorizations Workbench.

- Check

Select to credit the return by sending the Customer a Check. If selected, a Customer Check will be queued up for processing on the Return Authorizations Workbench. When the Check is processed, a sales Credit Memo will be created automatically—and the Check will be applied to it.

- Credit Card

-

Select to credit the return with a refund to the Customer's Credit Card. If selected, the payment will be queued up for processing on the Return Authorizations Workbench. A Credit Memo will be posted when the refund is processed—and the refund charges will be applied to it. If the timing of the credit is immediately, then you may issue the refund directly from the Line Items tab of the Return Authorization.

Note

The Credit Card functionality must be enabled at your site for the Credit Card method to function properly.

- Print on Save

Select to print a copy of the Return Authorization when you select the SAVE button. You must have a Form "keyed on" Return Authorizations for this option to work. The keyed on process is described here: Section 10.14.4.1, “Form”.

- Original Order #

-

You have the option to select an original Sales Order for all disposition types. When an original Sales Order is selected, all Line Items from the original Order will be imported into the Return Authorization automatically. For dispositions Credit and Return this feature imports the original pricing and billing information. When a Sales Order number is selected, the Customer Number and address information will be populated and disabled. If the Customer is selected first, only Sales Orders for that customer will appear on the search list.

Note

A Sales Order may be linked to only one open Return Authorization at a time.

- New Order #

For Return Authorizations having either Replace, Service, or Substitute dispositions, the system will automatically generate a new Sales Order for shipping purposes once any Line Item quantity has been authorized. Authorized Line Item quantities are added automatically to the new Sales Order, enabling you to ship the quantity at the appropriate time.

- Project #

You have the option to select a Project Number to associate with the Return Authorization. This enables you to link the Return Authorization with other Orders linked to the same project. The browse button located to the right of the field enables you to select from a list of available Projects.

- Customer #

Enter the Customer Number of the Customer whose return you are authorizing. The browse button located to the right of the field leads to a searchable Customers list. You may also access this list using the keyboard shortcut "CTRL + L".

Tip

A valid Customer Number must be entered in the "Customer #" field before Line Items can be added to a Return Authorization for all disposition types except Return. If no valid Customer Number is entered, you will not be able to add Line Items to the Return Authorization. Additionally, Return Authorizations may only be entered for active Customers.

- Cust. Type

Displays the Customer Type for the specified Customer.

- Bill-To Phone

Displays the Customer's Bill-To phone number.

- Address

-

Displays the Customer's Bill-To Address. You may manually override the displayed Address information in the fields below—or use the browse button to select another Address.

- Street Address

The Customer's Bill-To street Address.

- City

The Customer's Bill-To city.

- State

The Customer's Bill-To state.

- Postal Code

The Customer's Bill-To Postal Code.

- Country

The Customer's Bill-To country.

- Copy to Ship-to -\>

Select to copy contents of billing address into Ship-To address field. This option is enabled if the Customer master for the specified Customer indicates that free-form Ship-To's are allowed.

- Ship-To #

Enter the number of the preferred Ship-To Address. Customers may maintain multiple Ship-To Addresses. If the Customer master for the specified Customer indicates that free-form Ship-To's are allowed, then any address may be entered. If free-form Ship-To's are not allowed, then the Ship-To Address must be entered using the browse button located to the right of the field.

- Ship-To Phone

Displays the phone number for the specified Ship-To.

- Address

-

Displays the specified Ship-To Address. You may manually override the displayed Address information in the fields below—or use the browse button to select another Address.

- Street Address:

The specified Ship-To street Address.

- City

The specified Ship-To city.

- State

The specified Ship-To state.

- Postal Code

The specified Ship-To Postal Code.

- Country

The specified Ship-To country.

- Cust. PO #

Enter a Customer Purchase Order Number, as needed.

- Incident

You have the option to associate an Incident Number with the Return Authorization. The browse button located to the right of the field enables you to select from a list of available Projects.

At the top of the screen, the following buttons are available:

- SAVE

Creates the Return Authorization and saves the Return Authorization information. The SAVE button must be selected in order to save the Return Authorization record. It is not enough to save Return Authorization Line Item information. The Return Authorization header must also be saved.

- CANCEL

Closes the screen without creating a new Return Authorization, returning you to the application desktop.

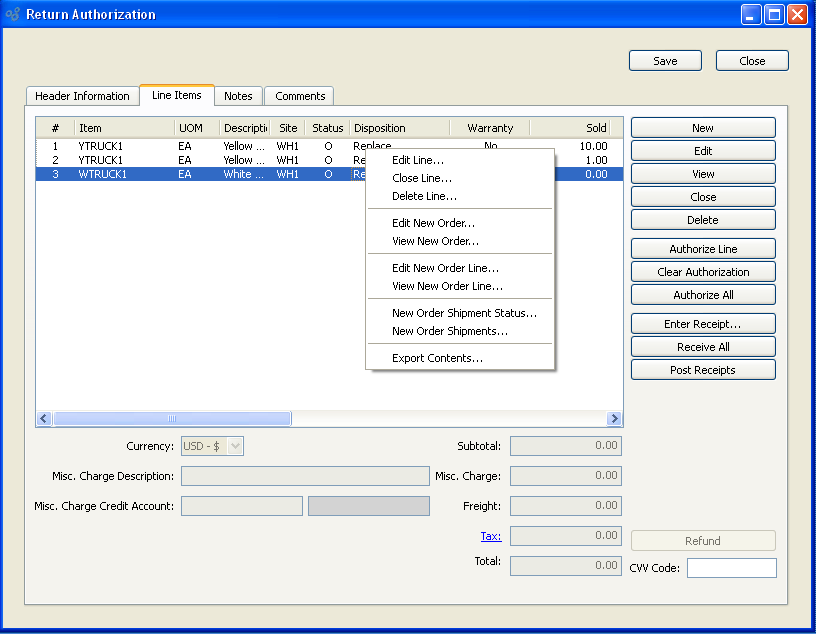

To create or modify Return Authorization Line Items, select the "Line Items" tab at the top of the "Return Authorization" screen. The following screen will appear:

When creating or modifying Return Authorization Line Items, you are presented with the following options:

- Line Items

Display lists Line Items for this Return Authorization. A valid Customer Number must be entered in the "Customer #" field before Line Items can be added to the Return Authorization for all Dispositions except Return.

- Currency

Select which currency will be used for this return.

- Misc. Charge Description

Enter a description to identify the miscellaneous charge.

- Misc. Charge Credit Account

Enter a Credit Account to assign the miscellaneous charge to.

- Subtotal

Displays the subtotal for the Return Authorization Line Items.

- Misc. Charge Amount

-

Enter the amount of any miscellaneous charge. Before entering a miscellaneous charge amount, you must first assign the charge to a Sales Account and also enter a description of the charge.

Tip

You may only enter miscellaneous charges on a Return Authorization only when a valid credit method is selected and a credit amount has been specified for one or more line items. Once a credit memo has been created against the Return Authorization, the header amounts may not be subsequently modified.

- Tax

Displays the total amount of Tax to be charged on the Return Authorization. The Tax amount displayed here represents the total for all Line Item Tax amounts. To get a detailed view of the Tax calculation, click on the Tax link using your mouse.

- Total

Displays the total amount of the Return Authorization.

- CVV CODE

Enter the Card Verification Value (CVV) Code found on the back of the specified Credit Card. This may be an optional feature at your site. Contact your Systems Administrator for details.

At the top of and to the far right of the screen, the following buttons are available:

- NEW

Opens screen for creating a new Return Authorization Line Item.

- EDIT

Enables you to edit highlighted Return Authorization Line Items. The edit screen is the same as that for creating a new Return Authorization Line Item—except that when editing, the fields will contain Return Authorization Line Item information. Double-clicking on a Return Authorization Line Item will also bring you to the editing screen.

- VIEW

Highlight a Return Authorization Line Item and then select this button to reach a read-only view of the "Edit" screen.

- CLOSE

Highlight a Return Authorization Line Item and then select this button to close the Return Authorization Line Item. If the highlighted Line Item is already closed, this button will revert to an OPEN button, which may be used to open the closed Line Item.

- DELETE

Highlight a Return Authorization Line Item and then select this button to remove the Return Authorization Line Item from the list.

- AUTHORIZE LINE

Highlight a Return Authorization Line Item and then select this button to authorize the Line Item quantity. This option is available only when an imported original Sales Order is being used—and then, the original Line Item quantity must be shipped before it may be authorized.

- CLEAR AUTHORIZATION

Highlight a Return Authorization Line Item and then select this button to change the authorization quantity to zero for the Line Item.

- AUTHORIZE ALL

Select to authorize the full quantity for all unauthorized Line Items. This option is available only when an imported original Sales Order is being used—and then, the original Line Item quantity must be shipped before it may be authorized.

- ENTER RECEIPT

Highlight an authorized Return Authorization Line Item and then select this button to receive the authorized quantity. The received quantity will be saved for subsequent posting.

- RECEIVE ALL

Select to automatically receive all authorized Line Item quantity. The received quantities will be saved for subsequent posting.

- POST RECEIPTS

Select to post all pending receipts for the Return Authorization.

- REFUND

Select to issue the specified Customer a refund on their Credit Card. This option is only available for credits issued by Credit Card. Your system must also be configured to use Credit Cards for this option to work.

Right-clicking on an Item in the Line Items list enables you to select from the following menu options:

- Edit Line

Enables you to edit highlighted Return Authorization Line Items. The edit screen is the same as that for creating a new Return Authorization Line Item—except that when editing, the fields will contain Return Authorization Line Item information. Double-clicking on a Return Authorization Line Item will also bring you to the editing screen.

- Close Line

Highlight a Return Authorization Line Item and then select this button to close the Return Authorization Line Item. If the highlighted Line Item is already closed, this button will revert to an OPEN button, which may be used to open the closed Line Item.

If a new Sales Order has been created for the Return Authorization, the following additional options will be available:

If the Line Items were imported from an original Sales Order, the following additional option will be available:

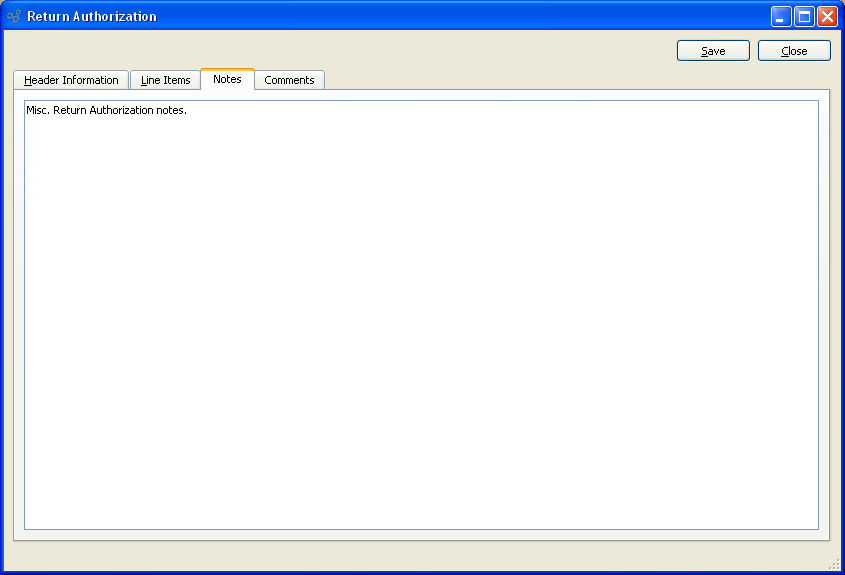

Order Notes added to a Return Authorization are used for internal purposes only. To add Notes to a Return Authorization, select the "Order Notes" tab at the top of the "Return Authorization" screen. The following screen will appear:

When adding Notes to a Return Authorization, you are presented with the following options:

- Order Notes

This is a scrolling text field with word-wrapping for entering general Notes related to the Return Authorization. These Notes are for internal use only.

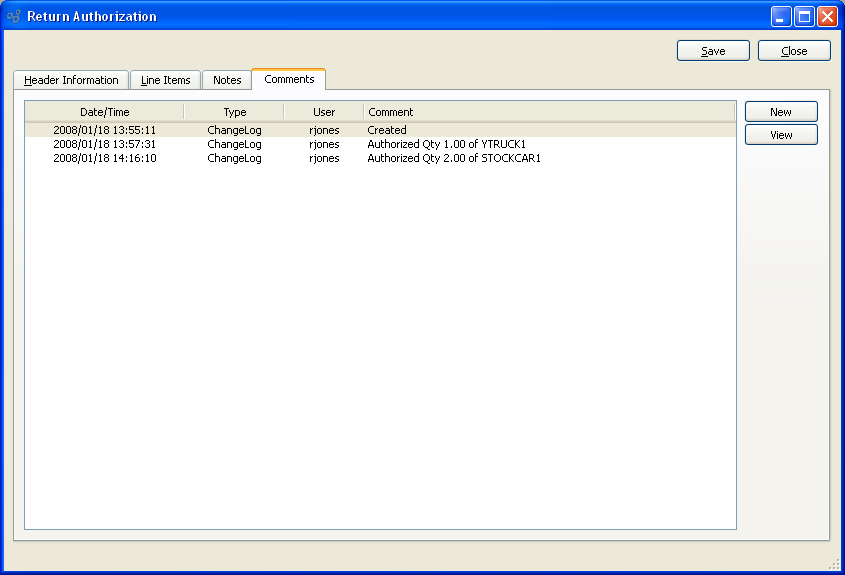

To add Comments related to a Return Authorization, select the "Comments" tab. The following screen will appear:

When adding Comments related to a Return Authorization, you are presented with the following options:

- Comments

Display lists Comments for the specified Order.

To the far right of the screen, the following buttons are available:

- NEW

Opens screen for creating a new Comment.

- VIEW

Highlight a Comment and then select this button to reach a read-only view of the Comment.

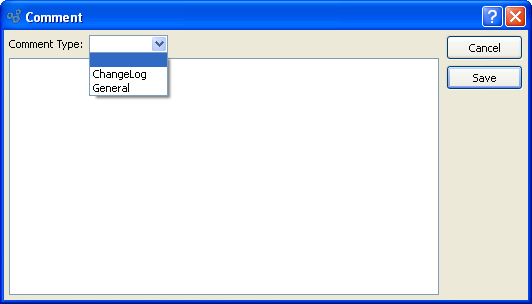

To create a Return Authorization Comment, select the NEW button. The following screen will appear:

- Comment Type

Specify one of the following Comment Types from the drop-down list: ChangeLog or General. Comment Types are used to categorize Comments. Once you have specified a Comment Type, you may type your Comment in the main text area. The text area features word-wrapping and scroll-bar support for longer Comments.

To the far right of the screen, the following buttons are available:

- CANCEL

Closes the screen without creating a new Comment, returning you to the previous screen.

- SAVE

Creates the Comment and adds it to the list of Order Comments.

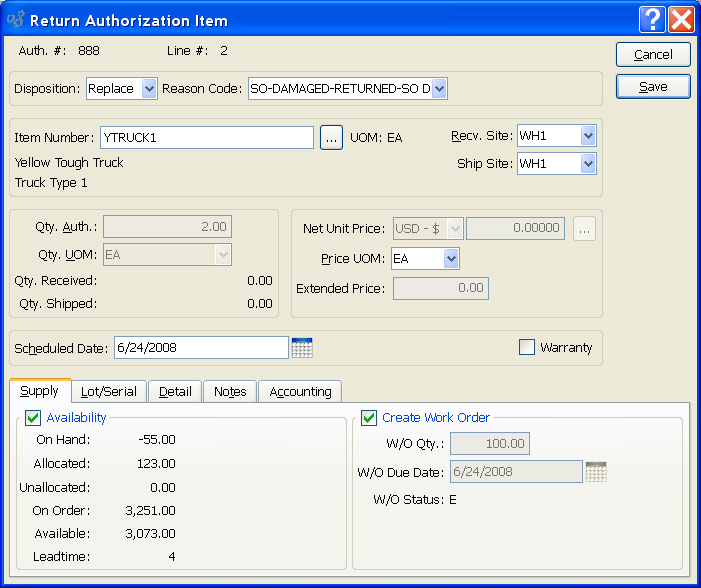

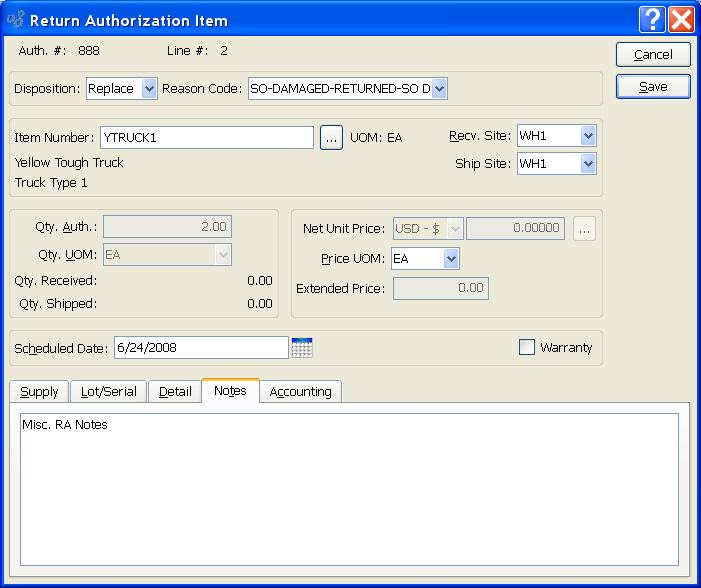

To add a new Return Authorization Line Item, select the NEW button. The following screen will appear:

When creating a new Return Authorization Line Item, you are presented with the following options:

- Auth #

Displays the Return Authorization Number specified on the Return Authorization header.

- Line #

Displays the Line Item Number for the current Line Item.

- Original Order #

-

Displays the original Sales Order Number if the Line Item has been imported into the Return Authorization. Importing Return Authorization Line Items from an original Sales Order is optional only. When Line Items are imported, the original quantities and pricing information are imported also.

- Line #

Displays the original Sales Order Line Item Number.

- New Order #

-

Displays the Order Number for the new Sales Order created in support of the Return Authorization, if applicable. New Sales Orders will be automatically created for Return Authorizations having the following dispositions: Replace, Service, Ship.

- Line #

Displays the Line Item Number for the new Sales Order.

- Disposition

-

Line Item dispositions are defaulted conditionally based on the Return Authorization's header-level disposition setting. However, you may manually over-ride the line level disposition when creating or Return Authorization Line Items provided you do so before a quantity has been authorized. The following options are available:

- Credit

Select to authorize the issuing of credit for the specified Item quantity at the specified Price. No return is required or expected.

- Return

Select to authorize the return of the specified Item quantity at the specified Price.

- Replace

Select to authorize the replacement of the specified Item quantity.

- Service

Select to authorize the servicing of an Item for the specified quantity. This disposition is valid only for Items having the Job Item Type. The Price controls will be disabled for this disposition. A new corresponding Sales Order and line will be created if one does not already exist. If any money is to be billed for the service, this should be set at the new Sales Order line item.

- Ship

Select to authorize a shipment of a specified quantity on a new Sales Order. The Price controls will be disabled for this disposition. A new corresponding Sales Order and line will be created if one does not already exist. Any money to be billed should be set on the new Sales Order line item.

- Reason Code

Specify the reason for the Return Authorization. Reason codes are used to explain why a Customer return is being authorized. The Line Item inherits the Reason Code from the header, but may be overridden at the line level.

- Item Number

Enter the Item Number of the Item you want to authorize. The Items you may select will vary depending on the Line Item disposition. For example, only Job Items may be selected for Line Items having the Service disposition. Once an Item Number is entered, the Inventory Unit of Measure and Item description will automatically appear.

- Qty. Auth.

-

Enter the quantity of the specified Item you want to authorize.

Note

The quantity authorized is based on the quantity Unit of Measure.

- Qty. UOM

Specify the Unit of Measure to be used when authorizing the Line Item. Sold Items may be assigned multiple Selling UOMs. These alternate UOMs may be defined on the Item master. If a Line Item has no Selling UOM defined, then the Inventory UOM will be used here by default.

- Qty. Sold

Displays the Line Item quantity sold on the original Sales Order line if the Line Item was imported from an original Sales Order.

- Qty. Received

Displays the quantity received against the Return Authorization Line Item to date, if any.

- Qty. Shipped

Displays the Return Authorization Line Item quantity shipped to date, if any. This value applies to Line Items having a corresponding line on a new Sales Order.

- Restock Charge Discount %

Enter the amount of any restock charge discount, if any.

- Net Unit Price

Displays the Net Unit Price for the Sales Order Item. This information will be imported automatically for Return Authorizations linked to an original Sales Order if header disposition was Credit or Return when the order was imported. The browse button located to the right of the field leads to a Price List screen.

Note

The Price controls will be automatically disabled for Line Items if a credit method has not been specified or for line items having the following dispositions: Service and Ship.

- Price UOM

The Price Unit of Measure is the same as the Selling UOM. If an Item has Selling UOMs defined, then the Item may be sold and priced in these alternate UOMs. If no Selling UOMs are defined, then the Inventory UOM will be used here by default.

- Extended Price

Displays the Extended Price. The Extended Price for a Line Item is based on the quantity ordered multiplied by the Net Unit Price.

- Scheduled Date

The scheduled date is the date when the Line Item quantity should be shipped. The user who enters the Line Item is responsible for determining the scheduled date. After entering the scheduled date, hit the TAB key on your keyboard to display values in the remaining display only fields.

- Warranty

Select if the Line Item is a warranty Item. If selected, the Cost of Warranty Account will be used when shipping the Line Item, instead of the Cost of Sales Account. It will also be used when receiving warranty Items through a Return Authorization, instead of the Cost of Returns Account.

When entering Return Authorizations you have the ability to view current availability for Line Items. You may also create replenishment Orders if they are needed.

- Availability

-

Select to display Availability information for the Line Item in the following categories:

- On Hand

Displays the current Quantity on Hand value.

- Allocated

Displays the quantity allocated to current Sales Orders and/or Work Orders in the system. An Item is considered allocated to a Sales Order if a Sales Order Line Item exists for the Item—and that Line Item has not yet been issued to Shipping. An Item is considered allocated to a Work Order if the Item is a material requirement—and the material has not yet been issued to the Work Order. Once the current Line Item is saved, the "Allocated" value will increase by the quantity ordered.

- Unallocated

Displays the Quantity on Hand remaining after allocations have been accounted for, as in: QOH - Allocated Qty. = Unallocated Qty.

- On Order

If the Line Item is a manufactured Item, the quantity ordered by current Work Orders will be displayed. If the Line Item is a purchased Item, the quantity ordered by current Purchase Orders will be displayed.

- Available

Displays the available quantity. Available quantity is determined using the following formula: Unallocated Qty. + On Order Qty. = Available Qty.

- Lead Time

Displays the Item Site Lead Time for the specified Line Item.

Tip

The "Show Availability" feature can be turned on or off by default at the system level. If the feature is turned on, the Availability totals will display only after a Scheduled Date has been entered for the Line Item.

- Create Work Order

If the Line Item is a manufactured Item, select this option to automatically create a Work Order for the specified quantity. For make-to-order manufactured Items, this option will be selected automatically. A Work Order will be created to meet the Return Authorization demand once you save the Line Item to the Order. An Item is designated as make-to-order if the "Create W/Os to meet Sales Demand" flag on the Item Site master is selected. A Work Order created automatically from a Return Authorization Line Item will assume the same Order Number as the new Sales Order the Return Authorization Line Item is associated with—even if that Order Number has already been used by a previous Work Order.

- W/O Qty.

The quantity ordered by the Line Item will display here.

- W/O Due Date

By default, the scheduled date of the Line Item will display here.

- W/O Status

Displays the current status of the Work Order.

To the far right of the screen, the following buttons are available:

- CANCEL

Closes the screen without creating a new Return Authorization Line Item, returning you to the Return Authorization header.

- SAVE

Creates the new Return Authorization Line Item and adds it to the list of Return Authorization Line Items. If "Create Work Order" is specified, the associated Work Order will also be created.

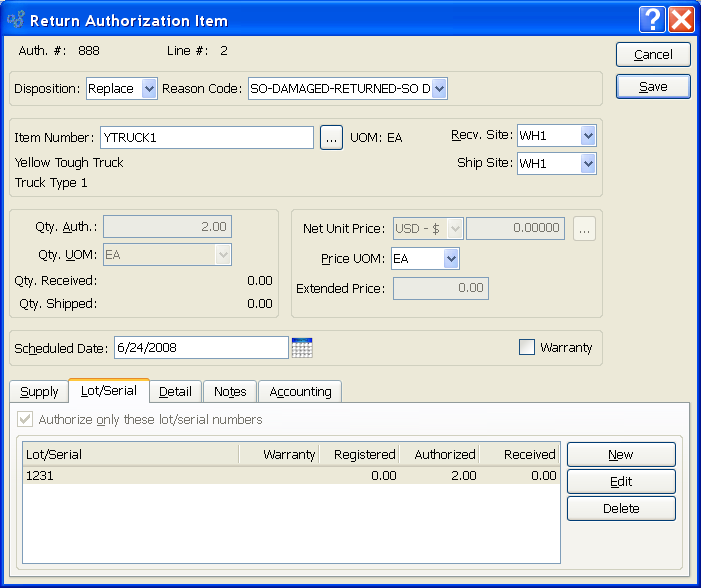

For Lot/Serial Items, you have the option to authorize only specific Lot/Serial quantities. The "Lot/Serial" tab will only be enabled for Lot/Serial Items. To authorize specific Lot/Serial quantities, select the "Lot/Serial" tab. The following screen will appear:

When authorizing specific Lot/Serial quantities, you are presented with the following options:

- Lot/Serial

Displays any Lot/Serial quantities specifically authorized for the Return Authorization.

- Authorize only these Lot/Serial Numbers

Select to enable the Lot/Serial selection process. When this option is selected, you will be able to select specific Lot/Serial quantities for authorization.

To the far right of the screen, the following buttons are available:

- NEW

Opens screen for creating a new Lot/Serial authorization.

- EDIT

Enables you to edit highlighted Lot/Serial authorization. The edit screen is the same as that for creating a new Lot/Serial authorization—except that when editing, the fields will contain Lot/Serial authorization information. Double-clicking on a Lot/Serial authorization will also bring you to the editing screen.

- DELETE

Highlight a Lot/Serial authorization and then select this button to remove the Lot/Serial authorization from the list.

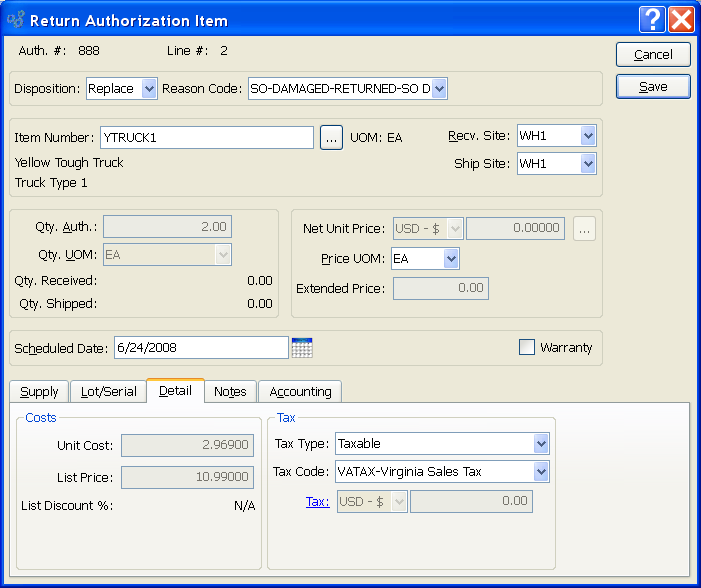

To view Costs or adjust Tax information for a Return Authorization Line Item, select the "Detail" tab at the bottom of the screen, as shown below:

When viewing Costs or adjusting Tax information for a Return Authorization Line Item, you are presented with the following options:

- Unit Cost (Inv. UOM)

Displays the Standard Cost per unit based on the Inventory Unit of Measure.

- List Price

Displays the sales List Price per unit.

- Customer Price

Displays the Price given to the specified Customer. Special Customer Prices can be set for individual Customers or Customer Groups by using a Pricing Schedule.

- Tax

-

The following Tax options are available, should you need to override the Tax Selection settings for the Line Item:

- Tax Type

Specify the Tax Type for the Line Item. By default, the Item's Tax Type corresponding to the Return Authorization's Tax Authority will be presented here. The link between Tax Types and Tax Authorities is made on the Item master. If the Item master does not have a Tax Type for the Return Authorization's Tax Authority, then no Tax will be charged.

- Tax Code

Specify the Tax Code to be applied to the Line Item. By default, the Tax Code specified in the Tax Selection matrix will be displayed here. For a Tax Code to be used, the matrix must have an entry which matches both the Item's Tax Type definition and the Tax Authority specified on the Return Authorization header. If no Tax Selection match exists, then no Tax Code will be used—meaning no Tax will be charged.

Tip

The relationship between Tax Authorities, Tax Types, and Tax Codes is established in the Tax Selection matrix.

- Tax

Displays the amount of Tax to be charged for the Line Item quantity. Sales Tax is calculated at the Line Item level. To get a detailed view of the Tax calculation, click on the Tax link using your mouse.

To enter Notes related to a Return Authorization Line Item, select the "Notes" tab at the bottom of the screen, as shown below:

When adding Notes related to a Return Authorization Line Item, you are presented with the following options:

- Notes

This is a scrolling text field with word-wrapping for entering general Notes related to the Return Authorization Line Item.

Tip

If a Return Authorization Item is marked to create a Work Order, the Production Notes for the created Work Order will contain the Sales Order Number, the Customer Name, and any additional Sales Order Line Item Notes.

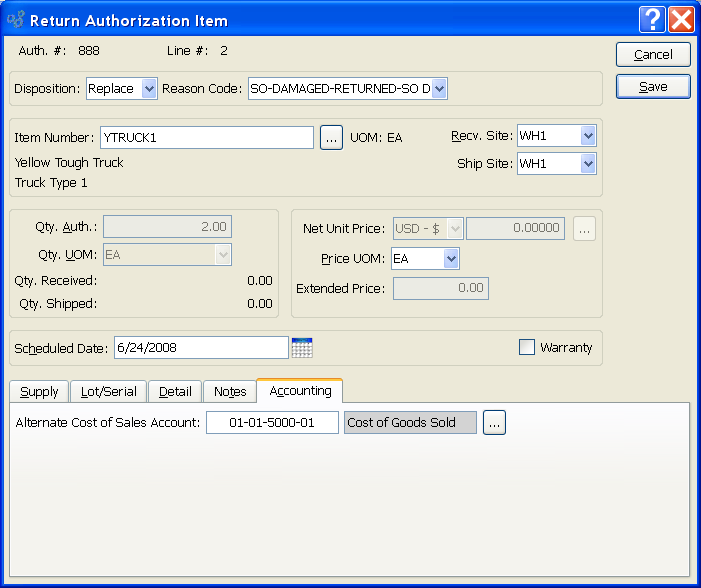

To define an alternate Cost of Sales Account for a Return Authorization Line Item, select the "Accounting" tab at the bottom of the screen, as shown below:

When defining an alternate Cost of Sales Account for a Return Authorization Line Item, you are presented with the following options:

- Alternate Cost of Sales Account

Specify an alternate Account to be used for the Cost of Sales. The Account you specify will be used instead of the typical Account pre-defined in the Sales Account Assignments.

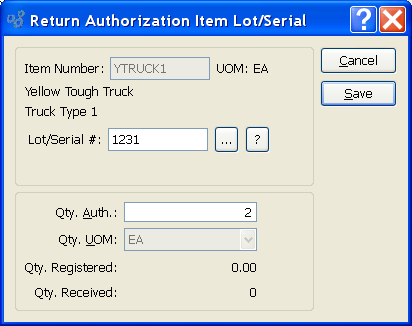

To authorize specific Lot/Serial quantities, select the NEW button. The following screen will appear:

When authorizing specific Lot/Serial quantities, you are presented with the following options:

- Item Number

Displays the Item Number specified for the Return Authorization Item. The Inventory Unit of Measure and Item description will automatically appear.

- UOM

Inventory Unit of Measure.

- Lot/Serial #

Select a pre-existing Lot/Serial Number for the Item. Or create a new Lot/Serial Number manually.

- Qty. Auth.

-

Enter the quantity of the specified Lot/Serial quantity you want to authorize.

Note

The quantity authorized is based on the quantity Unit of Measure.

- Qty. Registered

Displays the Lot/Serial quantity already registered. To learn more about Lot/Serial registration, see the Section 2.7.1, “Lot/Serial Registration” section.

- Qty. Received

Displays the quantity received against the Return Authorization Line Item to date, if any.

To the far right of the screen, the following buttons are available:

- CANCEL

Closes the screen without authorizing specific Lot/Serial quantities, returning you to the previous screen.

- SAVE

Creates the new Lot/Serial quantity authorization and adds it to the list of Lot/Serial authorizations for the Return Authorization Item.